Bitcoin Slips Under 200-Day Moving Average – Will The Downtrend Continue?

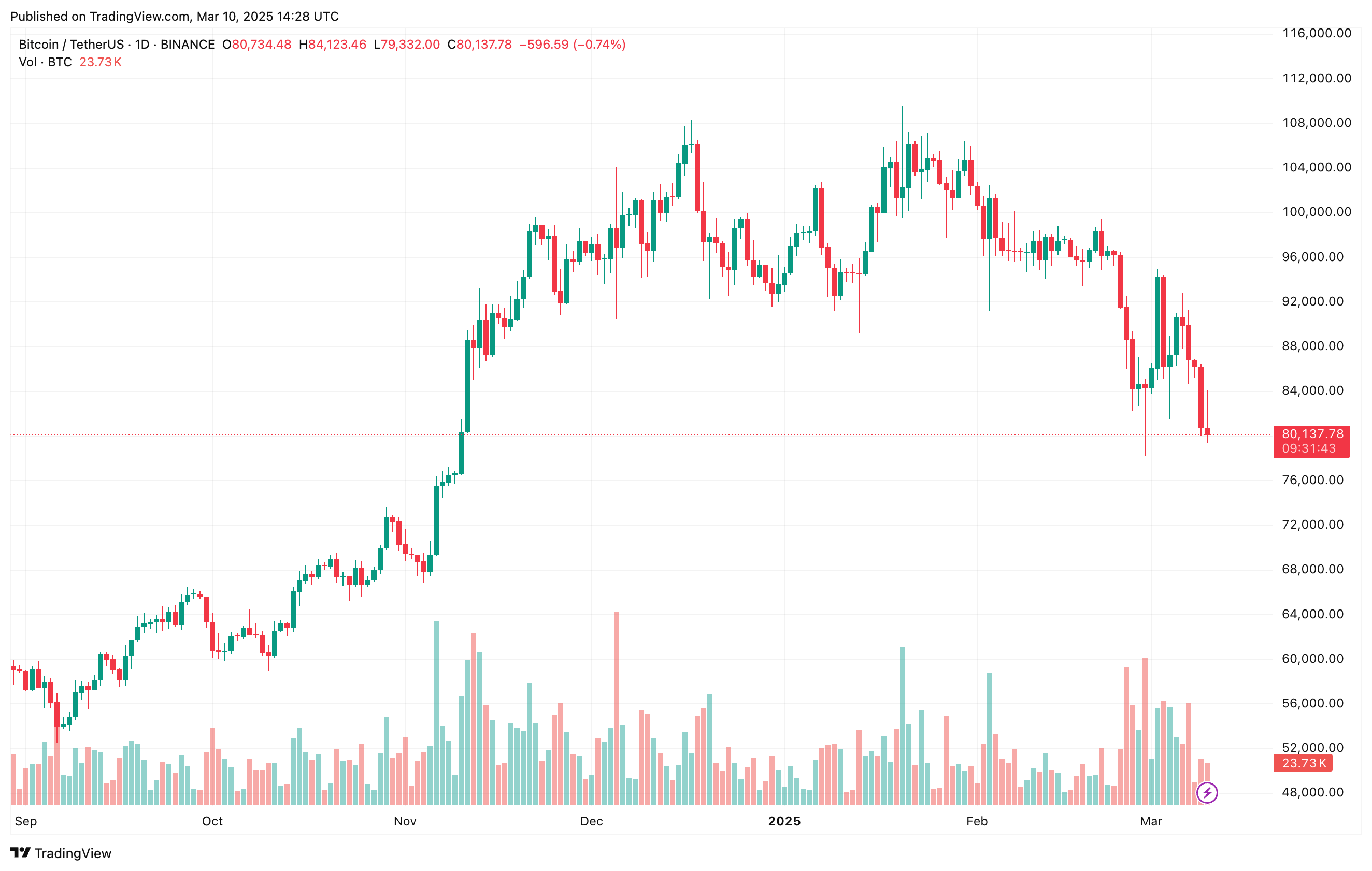

Bitcoin (BTC) has dropped 11.3% over the past week, currently trading in the low $80,000 range at the time of writing. The recent decline has pushed the leading cryptocurrency below the 200-day moving average (MA), raising concerns about a potential deeper pullback.

Bitcoin Must Defend This Key Price Level

According to an X post by seasoned crypto analyst Ali Martinez, BTC is now trading below the 200-day MA, a key price level that has historically functioned as a strong support for the top digital asset.

For the uninitiated, the 200-day MA is a famous technical indicator that essentially represents the average closing price of BTC over the last 200 days to identify the long-term price trend. Historically, a sustained movement above the 200-day MA has led to long-term uptrends while a prolonged price movement below the level has often preceded further declines.

Martinez stressed that BTC must remain above the TD Sequential indicator’s risk line at $79,280. He added that a sustained move above this level could set the stage for a strong rebound to the upside.

The potential for a BTC recovery was echoed by fellow crypto analyst Ted. In a post on X, he pointed out that over the past two years, BTC has frequently undergone 25% to 30% corrections before rebounding to new all-time highs (ATHs). Ted noted :

In 2023, BTC went from $30K to $22K. In 2024, BTC went from $74K to $50K. This year, BTC has dumped from $109K to $79K. We all know what happened after the last 2 major corrections.

If BTC follows a similar pattern and climbs 30% from its current price, it could reach approximately $104,000 in a short period. However, broader macroeconomic factors – such as US President Donald Trump’s trade tariffs and the Federal Reserve’s (Fed) monetary policy – could significantly impact BTC’s trajectory.

BTC Needs To Reclaim $84,000 First

In another post on X, Martinez outlined BTC’s potential path to a new ATH, emphasizing that BTC must first reclaim $84,000 as a support level before any major upside movement. Once this milestone is secured, the digital asset could rally toward $128,000.

Several indicators suggest that BTC may have already found a local bottom, increasing the chances of a trend reversal. Crypto analyst Rekt Capital recently noted that BTC’s plunge to $78,258 could mark the cycle low.

Additionally, the US Dollar Index (DXY) has just recorded one of its largest weekly breakdowns since 2013, a move that historically signals bullish momentum for risk-on assets like BTC. At press time, BTC trades at $80,137, down 3.5% in the past 24 hours.

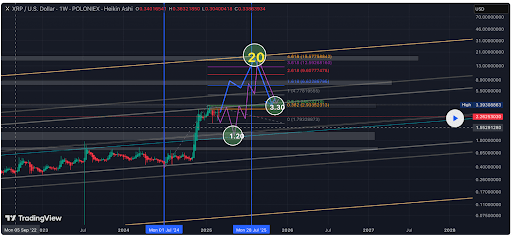

XRP Price Face Major Resistance At $2.9, Why This Analyst Believes $20 Is Still Possible

Crypto analyst ElmoX has asserted that the XRP price is still bullish despite the recent crypto mark...

The ECB Pushes for Digital Euro. Time to Invest in the Best Wallet Token?

Christine Lagarde, President of the European Central Bank, said that the ECB is aggressively pursuin...

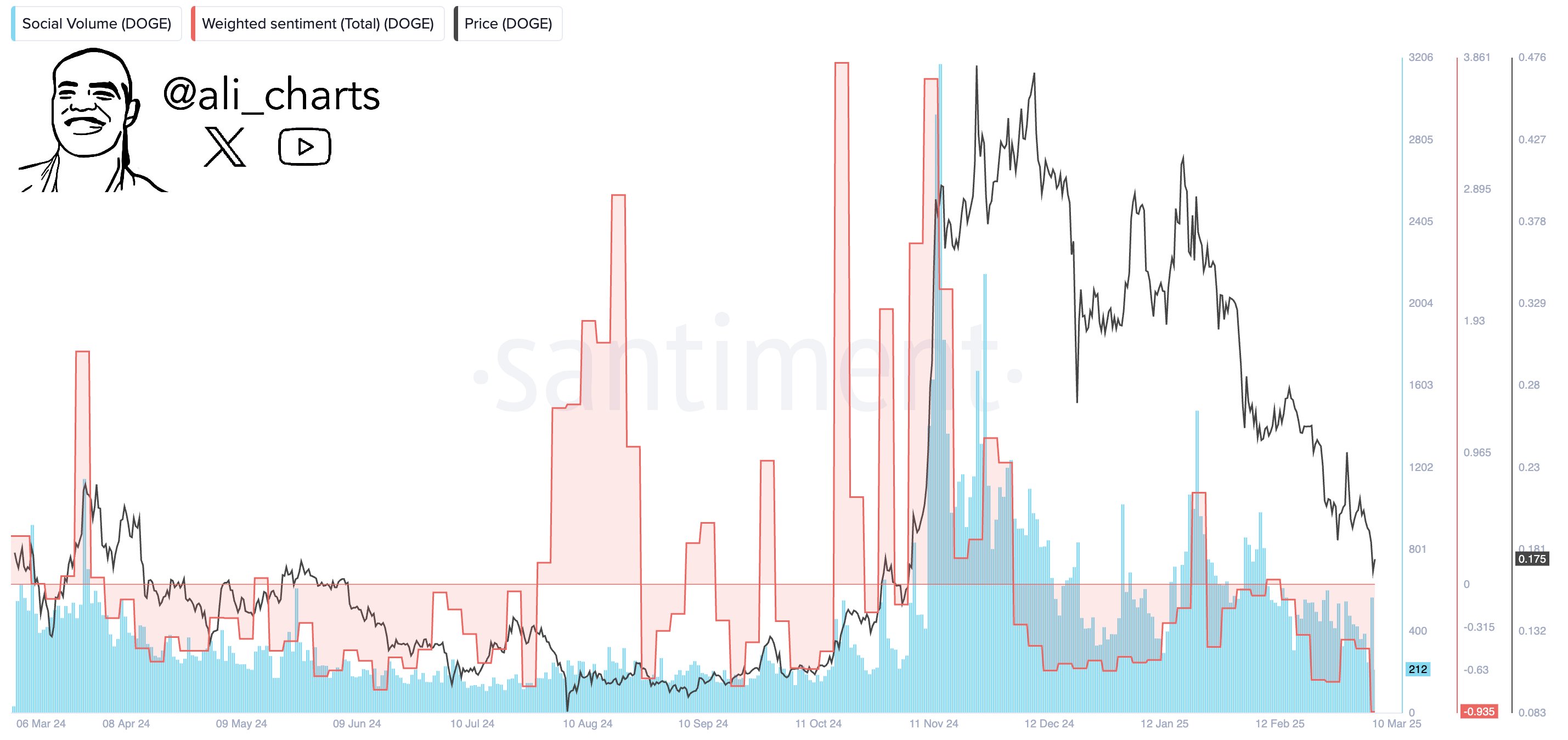

Dogecoin’s Darkest Hour? Sentiment Tanks, Whales Accumulate

Dogecoin’s sentiment has reportedly reached its most negative level in over a year. Crypto analyst A...