Bitcoin’s MVRV Ratio Nears Key Level—Will This Trigger a Major Reversal?

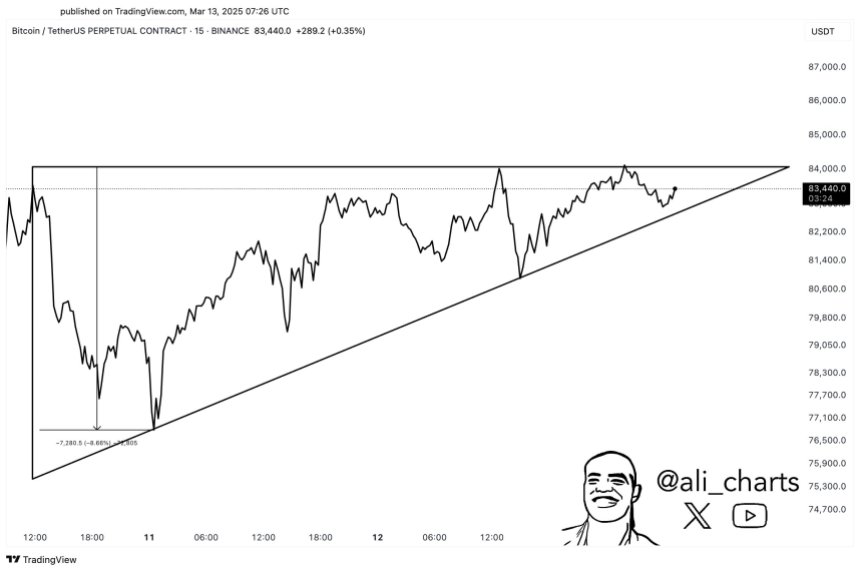

Bitcoin’s price has been experiencing a gradual recovery on a micro level, showing a 1% increase over the past 24 hours, bringing it back above $83,000. However, when viewed from a broader perspective, Bitcoin remains in a bearish trend, down 9.3% in the past week and 24.7% from its all-time high (ATH) in January.

This extended downtrend has raised concerns about whether the market is undergoing a deeper correction or if a potential reversal is on the horizon.

Possibility Of A Deeper Correction in Bitcoin

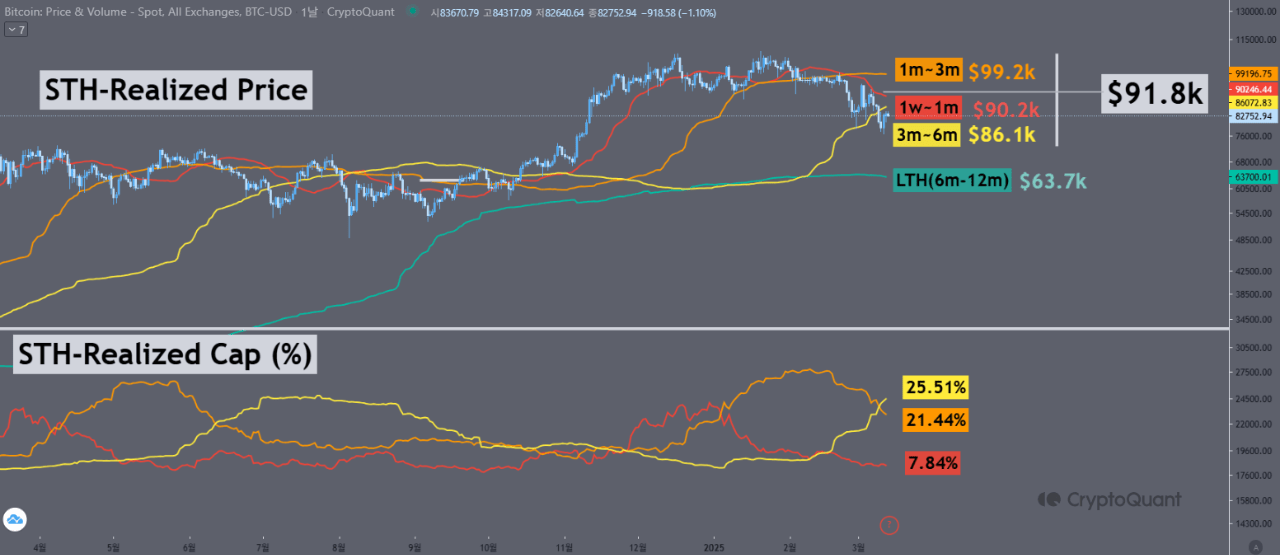

Analysts seem to have been closely monitoring Bitcoin’s market-value-to-realized-value (MVRV) ratio, which serves as a key indicator of whether Bitcoin is overvalued or undervalued based on historical price trends.

CryptoQuant analyst Crypto Dan recently provided insights into Bitcoin’s current market position, noting that the proportion of BTC holdings under one month surged in both March and December 2024, reaching 23% and 24.5%, respectively. This trend mirrors past movements that preceded price corrections.

With Bitcoin’s MVRV ratio now at 1.8, close to the 2024 correction low of 1.71, historical patterns suggest that a deeper decline to the $70,000 range could push the metric to similar levels seen in previous market bottoms.

Market in an Oversold Zone After a Strong Correction

“Even without an additional sharp decline, the market has already been sufficiently lightened, making it a favorable zone for a potential upward move without the need for further significant drops.” – By @DanCoinInvestor pic.twitter.com/mjLOQWlj4U

— CryptoQuant.com (@cryptoquant_com) March 13, 2025

Key Indicators Suggest a Potential Rebound

Despite the bearish sentiment, Crypto Dan emphasized that market conditions may already be near a turning point. He noted that altcoins have surrendered most of their recent gains, leaving many investors without profits in this cycle.

This indicates that the market has already undergone significant deleveraging , reducing the likelihood of further sharp declines. If no major sell-offs occur, Bitcoin could enter a favorable zone for an upward move, even without a drastic drop to the $70,000 range.

Dan also pointed out that the market is now in the final phase of its upward cycle, undergoing a strong correction that increases both risk and investment difficulty. However, as the market approaches an oversold state, the probability of a rebound also increases.

Dan highlighted that several key factors will determine whether this rebound materializes, including the strength and magnitude of the price recovery, whale activity, and changes in on-chain metrics during the rebound as well as Bitcoin’s correlation with the stock market and broader economic trends .

While the short-term outlook remains uncertain, Dan noted:

Despite the current stagnation, most cryptocurrencies, including Bitcoin, are in an oversold state, suggesting that a rebound is not far off. However, it is still too early to definitively conclude that the market has entered a full-fledged bear cycle.

Featured image created with DALL-E, Chart from TradingView

Bitcoin Faces Rejection At $84,000, But Analysts Show 2020 Similarities – Recovery Ahead?

Bitcoin (BTC) has failed to reclaim $84,000 resistance again and has fallen 4% to retest another cru...

Best AI Agent Coins to Buy as Investor Hype Remains Steady on AI Industry

Although it may seem like crypto dominated world markets for the better portion of the last half yea...

Bitcoin’s Price at a Crossroads—Will It Break $86K or Drop to $64K Support?

Bitcoin’s price appears to be still struggling below key levels. So far, the asset still trades belo...