Bitcoin Holds Around Key $85K Level: Will BTC Price Meet Buyers’ Demand?

The post Bitcoin Holds Around Key $85K Level: Will BTC Price Meet Buyers’ Demand? appeared first on Coinpedia Fintech News

The cryptocurrency market is starting to recover due to an overall increase in buying from traders. This boost follows a positive consumer price report and ease in global tensions. As a result, Bitcoin’s price is on its way to hitting $90K after getting past some key hurdles. However, with a bit of selling pressure now, investors are wondering if Bitcoin might start to drop again soon.

Bitcoin Recovers Following Positive News

Today, Bitcoin approached the $85K mark, fueled by bullish developments such as a positive Consumer Price Index (CPI) report and a reduction in geopolitical tensions. A key factor was Ukraine’s agreement to a temporary 30-day ceasefire with U.S. involvement, a move reported by Bloomberg that has cooled down the global market tensions. This decrease in geopolitical uncertainty has enhanced investor confidence and brought stability to the crypto market.

In addition, Ontario’s decision to eliminate a 25% tariff on electricity exports to Michigan, New York, and Minnesota has softened trade tensions and boosted overall market sentiment.

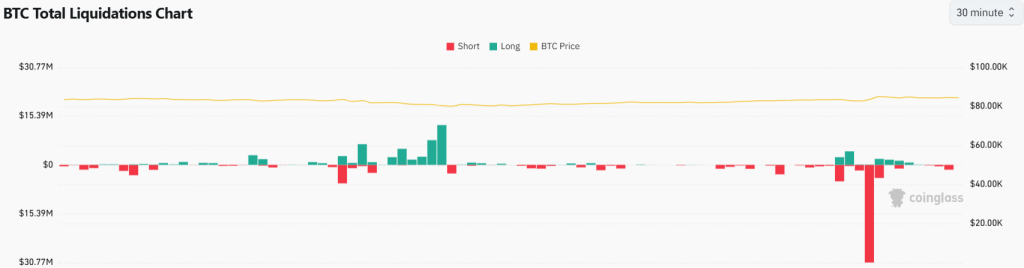

Data from Coinglass shows that Bitcoin saw significant market activity with around $75.4 million in positions liquidated over the last 24 hours. This included $15.4 million by buyers and $60 million by sellers, indicating an increase in short liquidations amid Bitcoin’s price rise.

The bullish momentum has also influenced Bitcoin’s market trends, with open interest in Bitcoin increasing by nearly 6%, reaching a high of $49.8 billion. IntoTheBlock data suggests a continued bullish trend as the exchange reserve declines.

Also read: Trump Crypto Executive Order Sparks New Bill for U.S. Bitcoin Reserve

The Netflow metric has consistently been in the negative, with a notable outflow of 3.1K BTC in the last 48 hours. This trend indicates that holders are moving their Bitcoin from exchanges to self-custody wallets, reducing the potential for selling pressure and pointing to continued upward movement in Bitcoin’s price.

What’s Next for BTC Price?

Bitcoin is currently riding a wave of strong bullish activity, targeting a stable position above the $85K mark. It briefly touched a peak of $85,309 before encountering resistance and slipping below $85K. Currently, bears are strongly defending a surge above 23.6% Fib channel. As of now, Bitcoin’s price trades at $84,593, marking a 5.3% increase over the last 24 hours.

Looking ahead, the BTC/USDT trading pair is challenging a resistance area within $84,205 to $86,704. Increased buying efforts are anticipated to ward off any significant pullbacks. Should Bitcoin successfully breach the $90K threshold, it could potentially aim for a climb towards $95,000.

Conversely, a failure to meet buyer interest near the $85K level might lead to a pullback, possibly dropping to a low of $79,974.

However, the long/short ratio of Bitcoin has taken a sharp downturn, currently standing at 0.67. This indicates an increasing dominance by sellers, who are likely pushing for an immediate correction in the BTC price chart. At present, about 60% of traders anticipate a decline in the price.

Chainlink’s Low MVRV Might Halt Recovery Rally: Will LINK Price Charge Ahead?

The post Chainlink’s Low MVRV Might Halt Recovery Rally: Will LINK Price Charge Ahead? appeared firs...

Shiba Inu Trader Predicts 7900% Rally to $16 for $0.20 SHIB Competitor: Here’s the Shocking Timeline

The post Shiba Inu Trader Predicts 7900% Rally to $16 for $0.20 SHIB Competitor: Here’s the Shocking...

El Salvador Keeps Buying Bitcoin Dips—Degens Are Loading Up on DuragDoge Before the Next Meme Run!

The post El Salvador Keeps Buying Bitcoin Dips—Degens Are Loading Up on DuragDoge Before the Next Me...