How High Can XRP Price Go After The Ripple Victory?

After more than four years, the US Securities and Exchange Commission is discontinuing its proceedings against Ripple in the XRP lawsuit. The announcement by CEO Brad Garlinghouse on X— stating “This is it – the moment we’ve been waiting for. The SEC will drop its appeal – a resounding victory for Ripple, for crypto, every way you look at it. The future is bright. Let’s build”—has generated waves of optimism among XRP supporters.

Although attorney Jeremy Hogan noted that Ripple can still take a range of actions, the consensus among market participants is that this development dispels a massive victory for Ripple. Hogan remarked that it is still unclear if Ripple agrees to drop the appeal. He added that there are 4 possibilities left:

a. Ripple continues its appeal, and we get a ruling from an appellate court on whether investment contracts require contracts, etc.. b. Ripple agrees to drop its appeal, jurisdiction returns to the trial court, and the parties attempt to amend the judgment. c. Ripple agrees to drop its appeal, and the parties enter into an agreement between them without trying to amend the judgment. d. Ripple just pays the $125mil and moves on.

How High Can XRP Go?

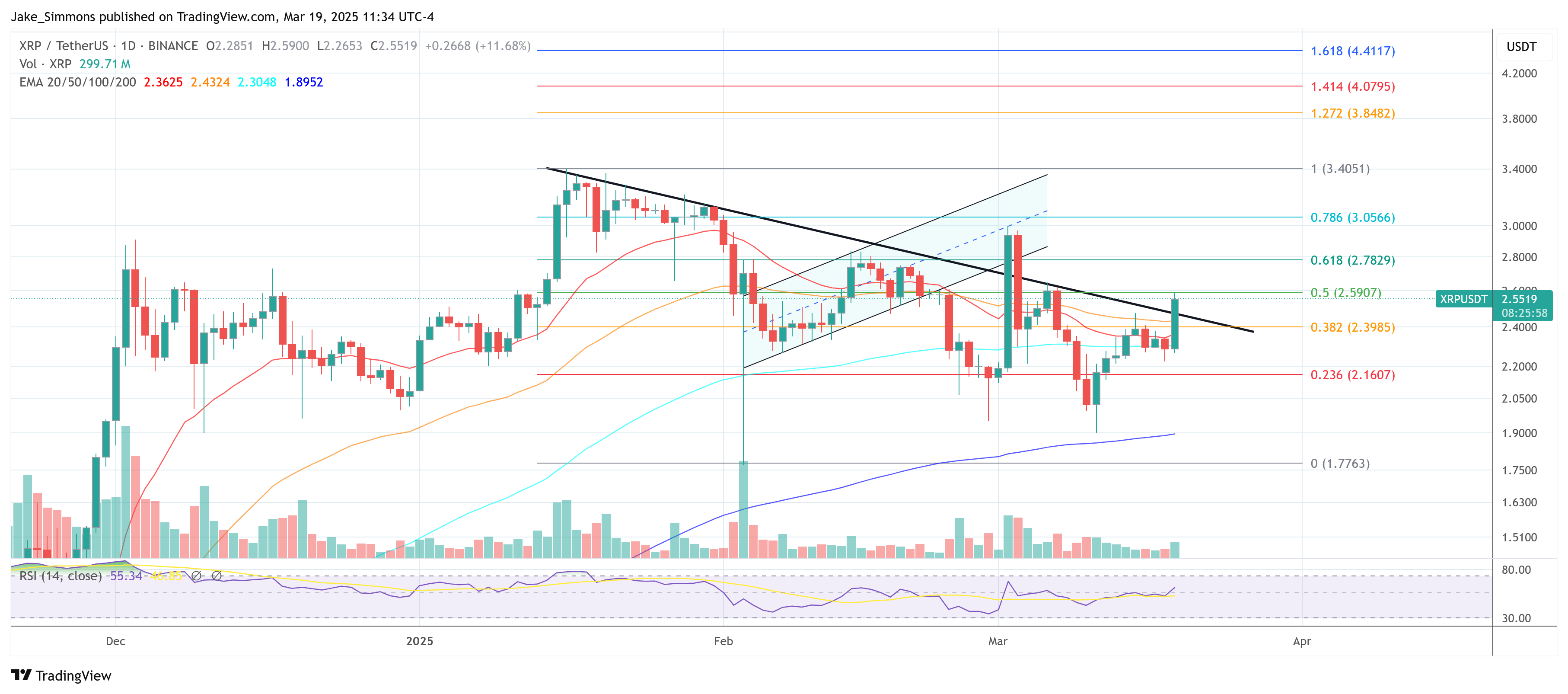

Against this backdrop, crypto analyst Dark Defender (@DefendDark) has shared an updated daily XRP/USD chart. According to it, XRP broke above a descending trend line that extends across several weeks of trading activity following the announcement.

The breakthrough near the $2.47 area, has been circled in green and labeled as “A Clear Break-Out” by Dark Defender, suggesting that market participants are no longer confined by the downward trajectory that characterized much of the previous price action.

The chart also outlines a Elliott Wave count aligned precisely with Fibonacci retracement and extension levels. The chart illustrates a completed corrective phase and the early development of a new impulsive wave structure, supported by the decisive breakout from a long-standing descending trendline.

According to the analysis, Wave (1) initiated from the local low of $1.79 and peaked around $2.55, marking the first bullish impulse. This was followed by Wave (2), which retraced into the Fibonacci support zone.

The retracement respected the 61.80% level at $2.3073 and approached the 70.20% level at $2.2249, indicating a technically sound corrective wave within the Elliott framework. These levels provided a strong foundation for buyers , preventing further downside and signaling the potential completion of Wave (2).

Following the corrective phase, the chart projects the start of Wave (3), traditionally the strongest in Elliott Wave theory. Fibonacci extension levels are plotted to define the likely targets for this wave. The 161.80% extension aligns at $3.94, serving as a critical target zone for Wave (3). Additionally, the 261.80% extension near $3.78 further supports this zone as a potential area where bullish momentum might face resistance or temporary consolidation.

However, Dark Defender predicts that XRP could rise even higher into the $4.50 region. Upon completion of Wave (3), the chart suggests a corrective Wave (4), which is expected to respect the broader uptrend and drop into the $3.78 to $3.94 region.

Subsequently, the final impulsive Wave (5) is projected to extend upon the 361.80% Fibonacci level at $4.9274. This marks a potential high within the current Elliott Wave cycle by the analyst, with the possibility of a surge above $6 , where the wave structure could culminate.

At press time, XRP traded at $2.55.

1 Million Bitcoin In New Whale Hands—A Mega BTC Rally On The Horizon?

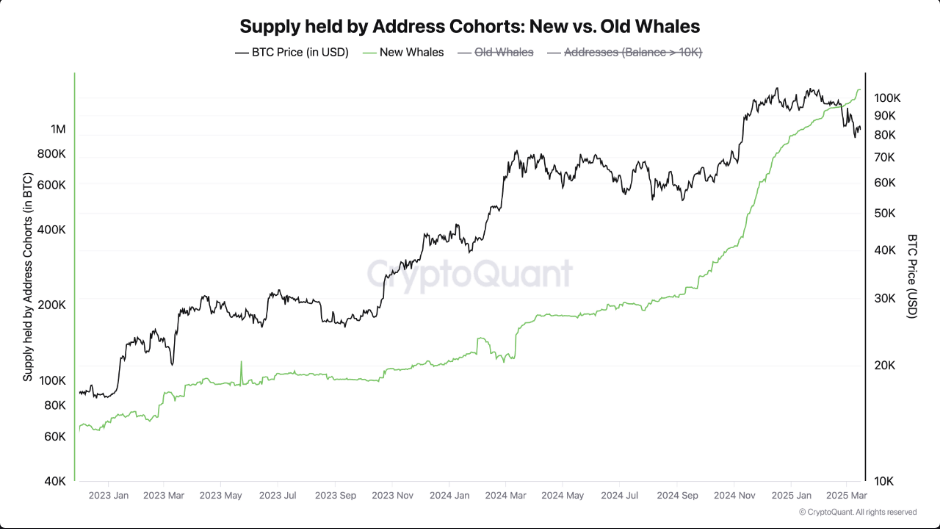

The latest wave of wealthy Bitcoin investors are enamored with the cryptocurrency. Since late Novemb...

Dogecoin Forms A Daily Bullish Pattern – Analyst Expects A Breakout To $0.43

Dogecoin is currently consolidating within a tight range, trading below the $0.18 mark and holding s...

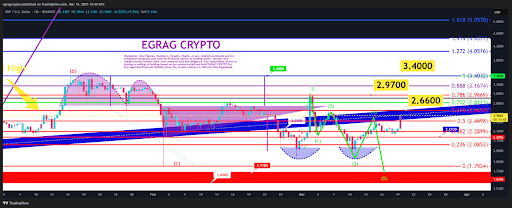

XRP Wave 4 Count: Why $2.66 Is The Most Important Level To Beat

Crypto analyst Egrag Crypto has discussed the possibility of the XRP price witnessing another correc...