How the Altcoin Season Index Helps Traders Maximize Crypto Gains

The Altcoin Season Index (ASI) has become a vital tool in cryptocurrency trading, especially for investors looking to understand market cycles and capitalize on altcoins. While Bitcoin (BTC) has long dominated the market, altcoins like Ethereum (ETH) often experience periods of significant price movements. The Altcoin Season Index tracks these fluctuations, helping traders and investors make informed decisions about when to invest in altcoins versus Bitcoin.

Understanding the Altcoin Season Index

The Altcoin Season Index is designed to track the performance of altcoins relative to Bitcoin. It provides insights into whether altcoins are outperforming Bitcoin in terms of market capitalization, which is essential for identifying market trends. The ASI is calculated by comparing the market capitalization of 50 altcoins (cryptocurrencies excluding Bitcoin) to the total market capitalization of all cryptocurrencies (including Bitcoin).

This ratio gives traders an idea of how much influence altcoins have in the market compared to Bitcoin at any given time. The formula for calculating the Altcoin Season Index is as follows:

Altcoin Season Index = (Number of Altcoins Outperforming Bitcoin (BTC) in the Last 90 Days/Total Number of Top 50 Altcoins)×100

Interpretation:

- If 75% or more of the top 50 altcoins have outperformed Bitcoin in the last 90 days → Altcoin Season

- If less than 25% have outperformed Bitcoin → Bitcoin Season

- If the percentage is between 25% and 75% → Neutral Market Phase

This calculation results in a percentage value that can either indicate a season where altcoins are gaining strength or a period where Bitcoin holds dominance. A high ASI suggests that altcoins are performing well, while a low ASI indicates that Bitcoin is dominating the market.

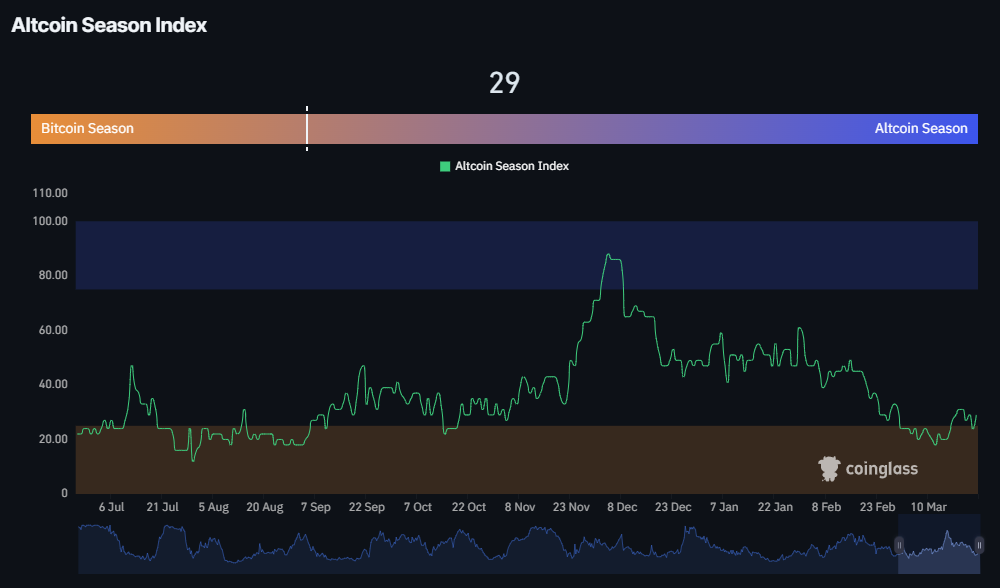

Interpreting the ASI Chart

The ASI chart is a visual representation of how the Altcoin Season Index has changed over time. Traders and analysts use this chart to identify trends in altcoin and Bitcoin performance. Here are some key points to consider when interpreting the chart:

1. Altcoin Seasons vs. Bitcoin Dominance

A high ASI (typically above 75) signals that altcoins are outperforming Bitcoin, which often leads to what is known as an “altcoin season.” During these periods, altcoins experience significant price movements, making them attractive to investors seeking higher returns. Conversely, a low ASI value suggests that Bitcoin is more dominant, and investors are focusing on Bitcoin as a safer investment, often in times of increased market uncertainty or when the broader market is bearish.

2. Cycles and Trends

The ASI chart can help investors understand the cyclical nature of the cryptocurrency market. Altcoins often go through phases where they outperform Bitcoin, followed by periods of Bitcoin dominance . Recognizing these cycles allows traders to time their investments more effectively. For instance, if an investor notices that altcoins have been outperforming Bitcoin for several weeks, they may consider moving some of their portfolio into altcoins. On the other hand, if the ASI is low, they may choose to stick with Bitcoin for its relative stability.

3. Market Sentiment and Risk Appetite

The fluctuations in the ASI reflect changes in investor sentiment and risk appetite. A rising ASI often indicates that investors are willing to take on more risk in search of higher returns, as they perceive altcoins as having greater growth potential. Conversely, when the ASI is falling, it can suggest a more cautious market where investors prefer the safety of Bitcoin or even move their assets to fiat currencies. This shift in sentiment can also be seen as a response to broader market conditions, such as regulatory uncertainty or macroeconomic factors.

Implications for Traders and Investors

For those trading or investing in the cryptocurrency market, understanding and using the ASI chart can provide several strategic advantages.

1. Timing Investments

By monitoring the ASI, investors can time their investments more effectively. For example, during an altcoin season, when the ASI is high, investors might decide to allocate more of their portfolio to altcoins, expecting to benefit from price increases. On the other hand, if the ASI is low, indicating Bitcoin dominance, they might reduce their altcoin holdings and increase their Bitcoin exposure.

2. Portfolio Diversification

The ASI also plays a critical role in helping investors diversify their portfolios. During times when altcoins are showing strong performance relative to Bitcoin, it may be a good time to shift some capital into altcoins. In contrast, during Bitcoin-dominant phases, diversifying into Bitcoin can be a safer choice. This approach ensures that investors can capture the growth potential of altcoins while managing risk by holding Bitcoin when market conditions favor it.

3. Risk Management

Understanding the ASI helps investors manage risk. By recognizing the shifts between altcoin seasons and Bitcoin dominance, traders can adjust their portfolios accordingly. During periods of Bitcoin dominance, altcoins may be more volatile, so reducing exposure to altcoins can help minimize losses. On the other hand, during altcoin seasons, increasing exposure to altcoins can maximize returns. However, it’s important to remember that the ASI is only one of many factors to consider when making investment decisions, and market volatility can still lead to unexpected price movements.

Limitations of the ASI

Despite its usefulness, the Altcoin Season Index has several limitations that investors should be aware of.

1. Data Interpretation

The ASI provides a snapshot of the market, but interpreting its movements requires a thorough understanding of the broader market context. For example, a sudden drop in the ASI may not always indicate that Bitcoin is poised to dominate. Other factors, such as technological developments, regulatory changes, or macroeconomic events, could be influencing the market. Therefore, it’s essential to use the ASI in conjunction with other tools and market analysis.

2. Volatility

The cryptocurrency market is known for its extreme volatility, and the ASI can experience rapid fluctuations. These changes might not always correlate with actual shifts in market sentiment. For example, a sudden drop in altcoin prices could trigger a brief decrease in the ASI, even if the overall market outlook for altcoins is still positive.

3. Market Influence

External factors such as government regulations, technological advancements, and overall market conditions can influence both Bitcoin and altcoin prices. These events might not always be reflected immediately in the ASI chart. For instance, news of an upcoming cryptocurrency regulation in a major market can trigger a sell-off in both Bitcoin and altcoins, temporarily distorting the ASI’s reflection of market conditions.

Conclusion

The Altcoin Season Index chart is a valuable tool for traders and investors navigating the complex world of cryptocurrency. It provides insights into when altcoins are outperforming Bitcoin and when Bitcoin is dominating the market. By tracking the ASI, traders can make more informed decisions about when to buy or sell altcoins and Bitcoin, helping them maximize profits and manage risk.

While the ASI offers useful insights, it should not be the only factor considered when making investment decisions. The cryptocurrency market is highly volatile and influenced by numerous external factors, making it essential to conduct thorough research and exercise prudent risk management.

Frequently Asked Questions (FAQ):

What is the Altcoin Season Index (ASI)?

The Altcoin Season Index measures how altcoins (cryptocurrencies other than Bitcoin) perform compared to Bitcoin over a 90-day period, helping traders identify whether altcoins or Bitcoin currently dominate the market.

How is the Altcoin Season Index calculated?

ASI = (Number of top 50 altcoins outperforming Bitcoin over the last 90 days / Total number of top 50 altcoins) × 100.

What does an ASI value indicate?

- ASI above 75: Altcoin Season (altcoins outperforming Bitcoin).

- ASI below 25: Bitcoin Season (Bitcoin outperforming altcoins).

- ASI between 25 and 75: Neutral market phase.

How can traders use the ASI chart?

Traders use the ASI chart to identify market cycles and trends, helping them decide when to invest in altcoins for higher returns or when to remain with Bitcoin for stability.

How does the ASI reflect market sentiment?

A rising ASI often signals increased risk appetite and optimism in altcoins. A falling ASI indicates investors prefer Bitcoin’s stability or are becoming cautious about overall market conditions.

What are the strategic implications of using ASI for traders?

Traders can use ASI to:

- Time investments by increasing altcoin holdings during altcoin seasons.

- Diversify portfolios strategically based on ASI trends.

- Manage risk by adjusting altcoin exposure according to market dominance.

What limitations does the ASI have?

- It must be interpreted in broader market contexts, as sudden drops or spikes may result from short-term events.

- Market volatility can lead to rapid fluctuations that might not reflect long-term trends.

- External factors like regulations and technological developments can significantly impact market dynamics but may not be immediately reflected in the ASI.

Should ASI be the sole indicator for investment decisions?

No. While ASI is helpful, traders should combine it with other analysis methods and thorough market research for comprehensive decision-making.

3745% ROI Predictions Have Experts Saying It’s the Best Crypto to Hold – With Cardano and Sonic in Focus

Explore Qubetics, Sonic, and Bitcoin Cash as the best crypto to hold in 2025. Learn about their uniq...

XRPTurbo Presale Raises Over 160,000 XRP, Set To Become The AI & RWA Launchpad On XRP Ledger

Ebeye, Marshall Islands, 25th March 2025, Chainwire...

Chainlink’s Price Could Reach $17 After $15.50 Breakout

Chainlink's price could break $15.50 resistance, potentially reaching $17. However, resistance at $1...