Bitcoin Rally To $95K? Market Greed Suggests It’s Possible

Bitcoin is on everyone’s crosshairs once more. The cryptocurrency shot up to $88,500 today, exciting traders who think the price will rise to $95,000 in the near term. But while optimism is high, so is caution. Some analysts are warning that a retreat back to $80,000 may occur before the next major rally starts.

Traders Show Signs Of Greed

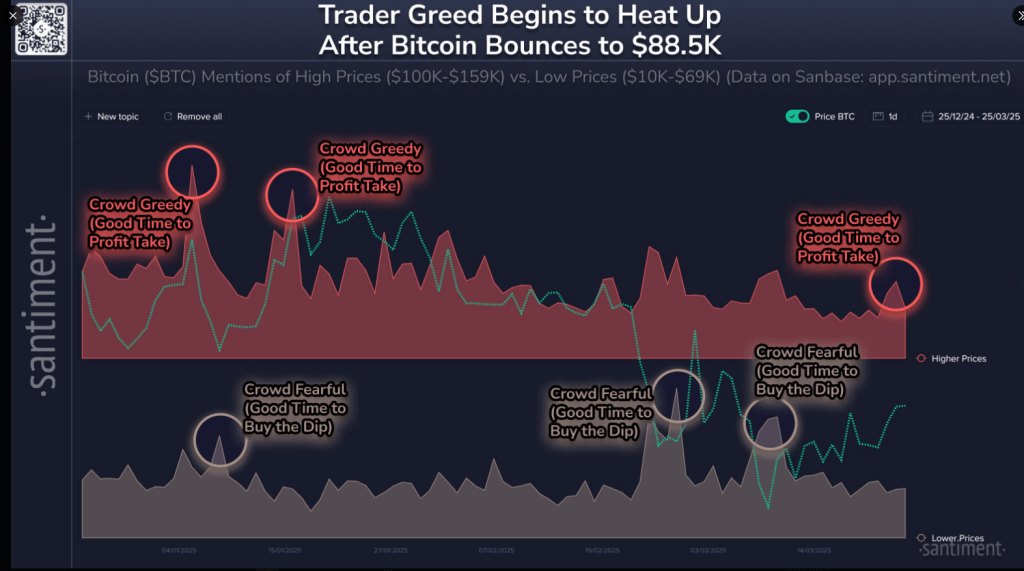

Market intelligence platform Santiment reports that greed is building among crypto investors. References of Bitcoin reaching $100,000 or even as high as $159,000 have surged through social media platforms. While hope is generating all the excitement, Santiment reminds that such peaks in greed generally precede an imminent price adjustment.

As crypto has bounced nicely in the second half of March, traders have swung the pendulum back toward mild greed. After showing major fear in late February and early March following two stints of Bitcoin dipping as low as $78K, it appears that this rebound to $88.5K has… pic.twitter.com/WGvmvKSv2X

— Santiment (@santimentfeed) March 25, 2025

Traders had also been holding back earlier in the year when Bitcoin fell to a low of $78,000. But that recent spike back to $88,500 does appear to have changed the general sentiment. Santiment suggests this might be an ideal time for traders to consider taking profits.

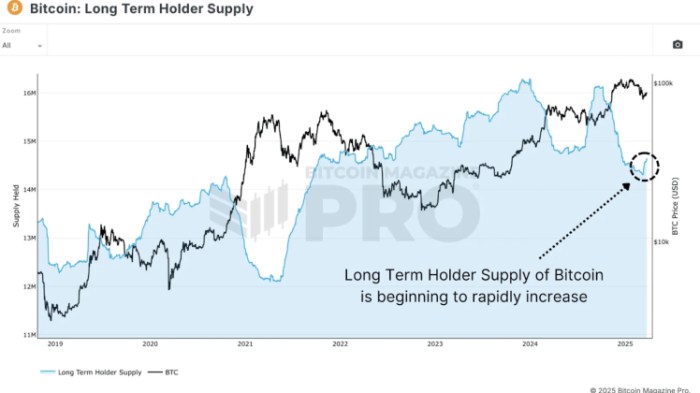

Miners Hold Onto Bitcoin Reserves

Bitcoin miners appear to be confident about the future. According to data from CryptoQuant, miners have not been selling much of their Bitcoin recently. In fact, miner reserves now total 1.81 million BTC, which is worth around $159 billion.

Ali Martinez, a crypto analyst, confirmed in a comment on X that no significant selling activity has been recorded among miners over the past 24 hours. This behavior could be a sign that miners are expecting higher prices and prefer to hold onto their earnings for now.

Institutional Interest Grows With ETF Inflows

Institutional Interest Grows With ETF Inflows

Institutional investors are also playing a big role in the market’s momentum. On March 25, Bitcoin spot ETFs in the US recorded a total daily inflow of $27 million. BlackRock , one of the largest asset management firms, led the way with $42 million in inflows that day.

Whereas some other funds such as Bitwise and WisdomTree experienced $10 million and $5 million outflows respectively, the robust demand for BlackRock helped in nudging the general trend into positive direction. BlackRock’s net assets in its Bitcoin spot ETF are currently at a little over $50 billion, demonstrating that institutional investors still have a passion for Bitcoin.

Analysts Expect Short-Term Fall Before RallyTechnical analysis is indicating Bitcoin might experience a temporary decline before the next peak. On its 4-hour chart, Bitcoin is having a difficult time surpassing a trendline of resistance, creating what experts refer to as a “double top” formation. The pattern suggests the potential for a price drop towards $85,000.

Meanwhile, the most important support level is at $86,146, according to the 61.80% Fibonacci retracement level. If Bitcoin manages to stay above this level, analysts indicate that the price may rebound and move towards $95,000.

Featured image from Gemini Imagen, chart from TradingView

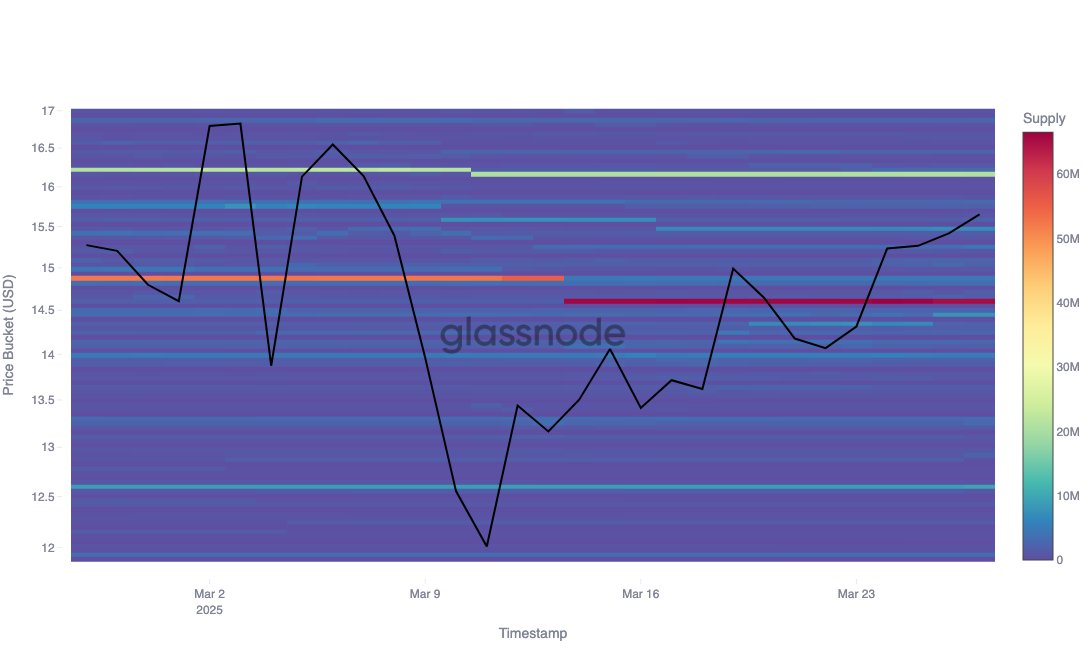

Support Or Resistance? Chainlink (LINK) Investor Data Suggests Key Price Zones

Market prices of Chainlink (LINK) suffered another major decline in the past 24 hours as the general...

Best New Meme Coins on Presale as Bitcoin Nears Next Bull Run

Bitcoin’s recent dip from an all-time high of $109K all the way to $77K rattled a lot of retail inve...

Bitcoin RSI Targets Daily Retest That Triggered 2024 Price Rally, What Happened Last Time

Crypto analyst Rekt Capital recently discussed the Bitcoin price action and provided insights into t...