BNB Surpasses Solana in Market Capitalization, Reclaims Fifth Spot

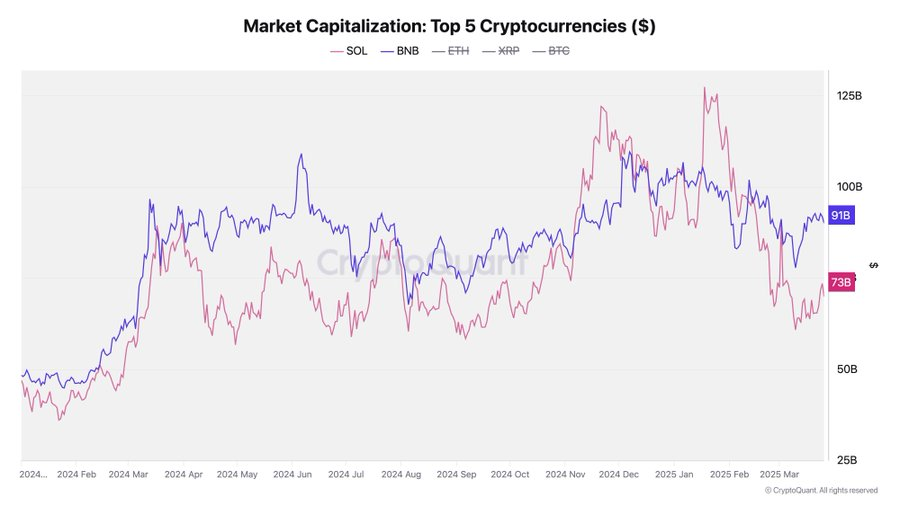

- BNB’s market cap has surpassed Solana’s, reaching $92 billion, while SOL is at $74 billion.

- Solana’s market cap spiked in late 2024 as a result of the meme coin ecosystem but was short-lived.

- BNB’s recovery is linked to increased attention on its meme coin activity, now trading at $626.86.

BNB has regained its rank as the fifth-largest cryptocurrency by market cap and has surpassed Solana (SOL). According to CryptoQuant data , BNB’s market cap has risen to about $92 billion, while Solana’s is $74 billion.

The change in the rankings came after Solana’s uptick in late 2024, which was primarily due to the adoption of its meme coin popularity. However, this has slowly changed, with the BNB Chain seeing increased meme coin activity. This is because BNB platforms like Four.meme allowed people to create over 12000 meme tokens in a single day.

Analyzing the Market Movements

While BNB benefited from this increased activity in meme coins, Solana’s market capitalization stagnated. Coinciding with this market shift, the inflow and outflow data for both assets tell an interesting story.

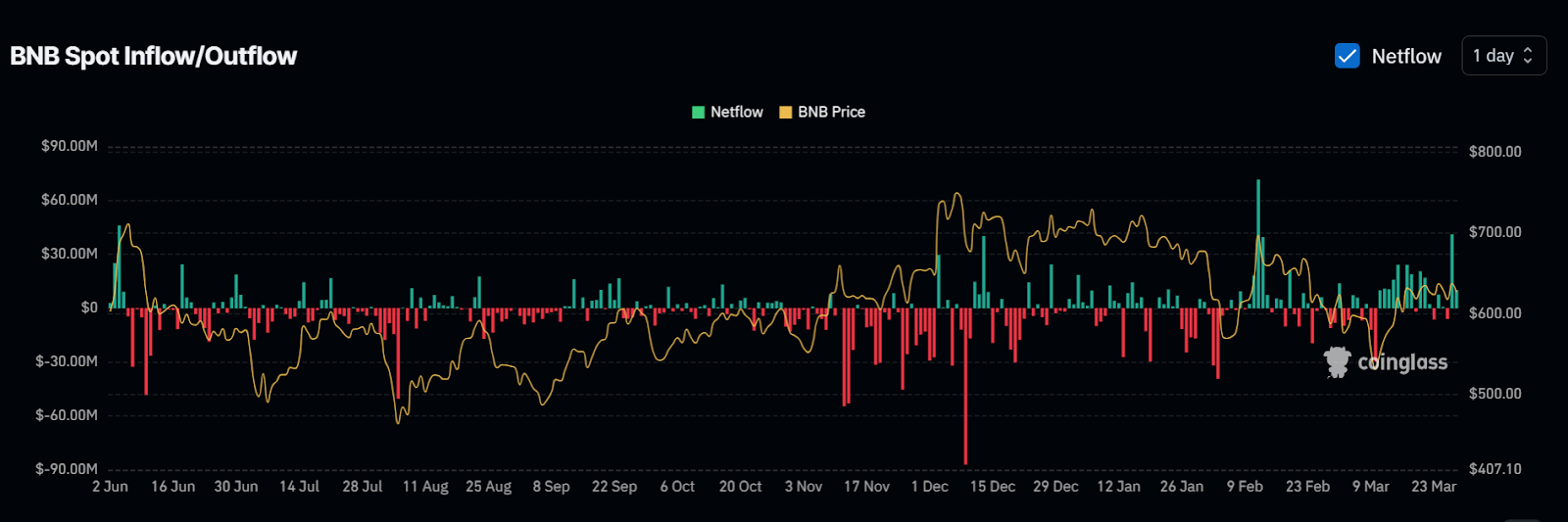

According to data from Coinglass, BNB has had consistent spot inflows for the past couple of months, stabilising it even when the price was volatile. However, Solana’s spot flows have more volatility, which shows the shifting nature of the relation between these two assets.

As of this writing, BNB is trading at $626.86, down by 1.68% in the last 24 hours. In contrast, Solana is $129.98 and experienced a greater percentage drop of 5.88% in the same period.

Recent trading data from CoinMarketCap reveals that BNB has performed significantly better in trading over the past few days than Solana. This is illustrated by the price chart, which shows BNB as comparatively stable while Solana has encountered a steep drop.

BNB Chain’s New $100 Million Incentive Program

As part of its continued efforts to establish a dominant market presence, BNB Chain has unveiled a new initiative to increase awareness of BNB native tokens in centralized exchanges. In its announcement, BNB plans to spend $100 million in incentives on these listings to foment valuable project growth across its blockchain network.

The rewards are based on exchange tiers, which define the amount of financial incentives to be given. Those tokens listed on tier 1 exchanges like Binance, Coinbase, or Upbit will be eligible for up to $500,000 per listing. The tier-two exchanges of Kraken, Bybit, and OKX will also grant $250,000 for each listing. For the projects listed in Tier 3 exchanges like Bitget, MEXC, Gate.io, KuCoin, and Crypto.com, the bounty hunt amount is fixed at $10,000 per exchange with an upper cap of $50,000.

Ethereum Faces Selling Pressure Amid Limited Price Support

As per the data from Glassnode, Ethereum $ETH is going through a significant downward pressure while...

Qubetics at $0.1430: Best Crypto Presale to Join in April with Ethereum and Arweave Pushing to New Heights in 2025

Explore the best crypto presale to join in April 2025, with insights on Qubetics' Real World Asset T...

Cambrian and a16z CSX Secure $5.9M to Advance AI-Driven Financial Intelligence

Cambrian secured $5.9M from a16z's CSX to develop AI-powered financial agents that use blockchain an...