Whale Opens $4.52 Million Ethereum Long Position, Now Holds $69.5 Million Unrealized Profit

Ethereum (ETH) is warming up as whales showing interest in the crypto asset, betting in a substantial price rise. Today, a whale deposited $4.52 million and went long on ETH with 20x leverage.

Whale long ETH with 20x leverage

This whale deposited $4.52 million USDC into Hyperliquid, using 50x leverage to long ETH. The whale’s unrealized profits have reached 47,253 ETH, worth $69.5 million. The investor went long at the price of $1,459 and will be liquidated if the Ethereum price falls to $1,391.7.

While this whale used a high level of leverage that could produce massive returns, it also involved substantial risks. ETH is currently trading at $1,504. With the use of 50x leverage, the whale risks facing liquidation with a just a price decline below $1,391.

The whale perfectly timed his transaction to align with post-Trump’s trade tariffs announcement. He confidently knows that Ether is in the final stage of its market correction.

Trump’s policy announcements have become significant accelerators of market movements. So far, Ethereum has endured lots of price drops since news associated with trade tariffs started making headlines early last month. The investor’s bet capitalized on long post-tariffs, as the whale knows that Ether’s corrective phase is becoming to an end.

Ethereum price updates

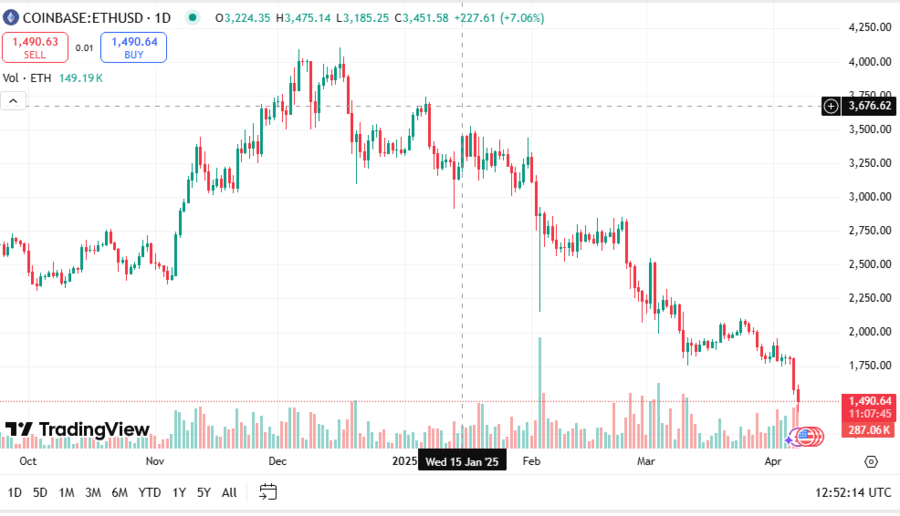

Of late, Ether has experienced tremendous sell-offs, with prices falling below $1,600 as liquidations spread across the market. ETH is currently standing at $1,504, down 15.3% over the past 24 hours. Its value has also been down 15.2% and 28.9% over the past week and one month ago, respectively.

Despite these declines, the asset struggles to restore investor confidence as Trump’s hostile trade taxes continue to shake global markets. Currently, on-chain indicators give out mixed results. According to metrics from Coinglass, Open Interest (IO) on ETH dropped by 15.45% over yesterday, showing traders’ confidence is waning and market participants are heightening their selling.

However, transaction volume has risen by 461.92% over the period, suggesting significant ETH outflows from exchanges. Long-term buyers, especially whales, seem to be withdrawing ETH tokens from exchanges and holding them in cold storage. Once positive market sentiment is restored, these declines in Ethereum supply on exchanges could potentially build conditions for price resurgence.

Should selling activity continue, ETH is likely to drop to the support levels of $1,473 and $1,459. On the other hand, if buying pressure builds up, the asset is set to see recovery, likely to surge towards the resistance levels of $1,520 and $1,557.

StarAI and Endless Unite to Elevate Decentralized AI Innovation

StarAI and Endless unite to drive decentralized AI adoption, now enabling intelligent, scalable Web3...

Footprint Analytics Partners AI Flow to Supercharge Web3 Data with Artificial Intelligence

The latest partnership between Footprint Analytics and AI Flow aims to revolutionize the Web3-based ...

Ardor Tops Daily Crypto Gainers with 131% Spike on April 16

Ardor leads April 16 crypto rally with a 131% surge as small-cap tokens like FUEL, SNT, and OM post ...