CoinDCX Review 2025: Is it the Best Crypto Exchange in India?

CoinDCX has rapidly emerged as one of India’s leading cryptocurrency exchanges since its founding in 2018 by Sumit Gupta and Neeraj Khandelwal. What began as an effort to bridge the gap in India’s nascent crypto market has evolved into a comprehensive digital asset ecosystem. This review delves into CoinDCX’s offerings, its innovative business model, security measures, and overall market impact, providing an in‐depth look at why it stands out in the competitive world of crypto trading.

A Gateway for Indian Crypto Enthusiasts

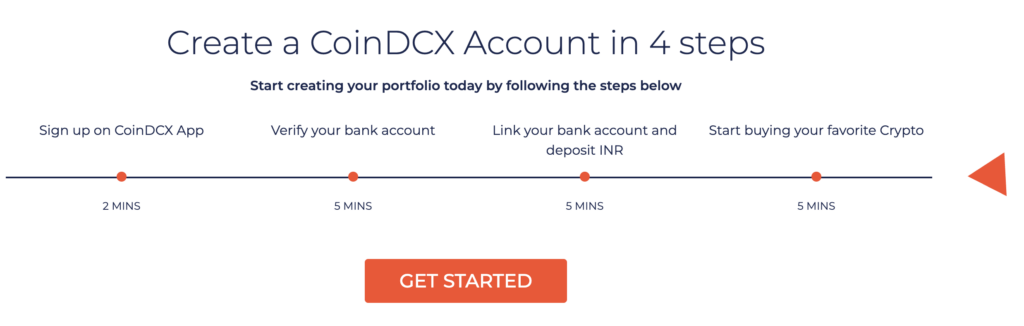

CoinDCX was conceived at a time when reliable and user‐friendly platforms were scarce in India. The founders’ vision was to democratize access to digital assets by creating an interface that caters to both beginners and experienced traders. Today, CoinDCX boasts a robust suite of features ranging from spot trading to advanced tools like margin and futures trading, staking, and lending services. By aggregating liquidity from top global exchanges, it offers Indian traders a seamless entry into the crypto world with the ease of local fiat integration (viz., Indian Rupees).

Comprehensive Trading Suite

At its core, CoinDCX provides a diverse array of trading options:

- Spot Trading: The platform offers real‑time trading of popular cryptocurrencies like Bitcoin, Ethereum, Ripple, and several altcoins. The user-friendly dashboard, enhanced with TradingView’s charting capabilities, makes it simple to track market movements and execute trades efficiently.

- Margin & Futures Trading: For more seasoned traders, CoinDCX enables margin trading with up to 6x leverage and futures trading up to 15x. While these leverage limits might seem modest compared to some global competitors, they are designed to balance risk and reward in a market that is still evolving within India.

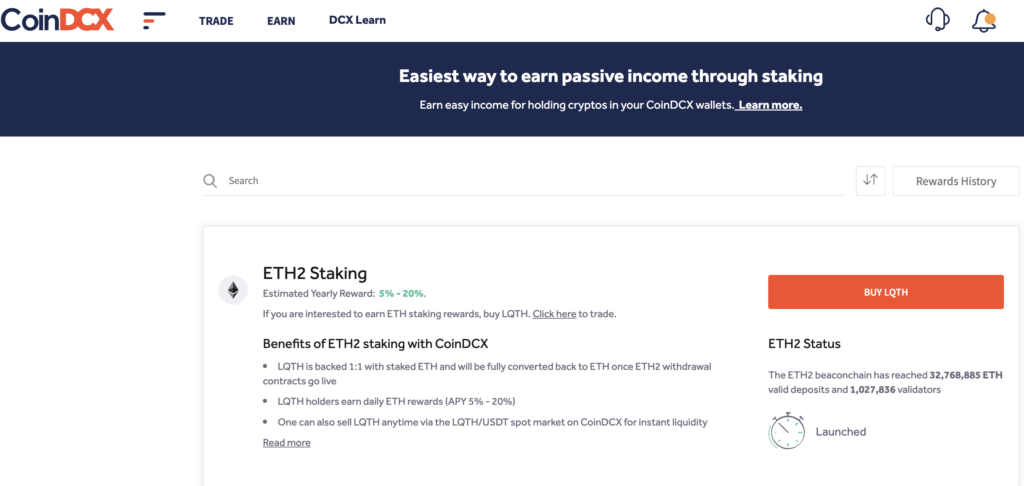

- Staking & Lending: CoinDCX also allows users to stake their crypto assets to earn rewards or lend them for additional interest income. These features not only increase the utility of the platform but also provide avenues for passive income, encouraging long-term investment.

This multifaceted approach makes CoinDCX a one-stop shop for cryptocurrency enthusiasts, whether they are simply looking to invest or engage in sophisticated trading strategies.

Security as a Cornerstone

One of the most critical concerns in cryptocurrency trading is security. CoinDCX addresses this head-on by implementing industry-leading security protocols. The platform utilizes multi-signature wallets through partnerships with BitGo and integrates Ledger hardware wallet support for an added layer of safety. With two-factor authentication, withdrawal whitelists, and regular security audits, CoinDCX ensures that user funds remain secure, even as cyber threats continue to evolve. Their recent transparency report— published in March 2025—highlights robust reserve metrics and the growth of its insurance protection fund (CIPF), reinforcing the platform’s commitment to trust and resilience.

Innovative Business Model

CoinDCX’s business model is built primarily on a trading fee structure, with fees typically ranging from 0.1% to 0.3% per transaction. This model not only drives revenue but also allows the platform to reinvest in technology and security enhancements. Moreover, as India’s first hybrid liquidity aggregator, CoinDCX benefits from sourcing liquidity from major global exchanges such as Binance, HitBTC, and Huobi Global, ensuring competitive pricing and minimal market slippage.

The company’s revenue streams extend beyond mere trading fees. With additional income from premium services, sponsored promotions, and innovative features like referral bonuses and airdrop campaigns, CoinDCX has created a vibrant ecosystem. This diverse revenue model has played a significant role in its rise to unicorn status, a rare achievement among startups in India’s competitive financial services sector.

User-Centric Approach and Educational Outreach

CoinDCX has not only built a powerful trading engine but also focused on making cryptocurrency accessible to a broad audience. Their suite of educational tools—including blogs, tutorials, webinars, and live support—helps demystify crypto trading for newcomers. Initiatives like “CoinDCX Go” are specifically tailored for beginners, enabling them to understand market dynamics without feeling overwhelmed by technical jargon.

The emphasis on user education has been pivotal in driving crypto adoption in India. As reported in industry surveys, this commitment has helped reduce entry barriers, allowing even first-time investors to participate confidently in the crypto market. This user-centric approach underlines CoinDCX’s mission to democratize finance and foster a culture of informed investing.

Market Impact and Strategic Positioning

CoinDCX has managed to carve a niche for itself in a highly competitive market. With over 16 million registered users and a significant portion of India’s growing crypto community relying on its services, CoinDCX has proved its mettle. The platform’s ability to attract a diverse user base—from retail investors in metropolitan areas to budding traders in tier‑II cities like Jaipur, Lucknow, and Patna—speaks volumes about its widespread appeal.

Strategic partnerships and robust funding from notable investors such as Bain Capital, Polychain Capital, and Coinbase Ventures have further bolstered CoinDCX’s market position. These partnerships not only enhance the platform’s technological capabilities but also ensure that it remains agile in an industry marked by rapid regulatory and market changes. By aligning itself with global crypto leaders while focusing on the unique needs of Indian investors, CoinDCX has successfully positioned itself as a trailblazer in the digital asset space.

Balancing Innovation with Caution

Despite its many strengths, CoinDCX is not without its challenges. Some users have raised concerns regarding the limited number of listed coins compared to other global exchanges, and occasional issues with withdrawal processing have been reported. While these concerns are important, they reflect the growing pains typical of rapidly expanding platforms in a still-maturing market. CoinDCX appears to be addressing these issues through continuous updates, customer support enhancements, and expanding its coin listings gradually to meet market demand.

Moreover, the leverage offered on margin and futures trading, while safer for risk management, might not satisfy traders looking for aggressive high-leverage opportunities. Nonetheless, this conservative approach has likely contributed to the platform’s robust security record and long-term sustainability, ensuring that user funds remain protected in volatile market conditions.

Transparency and Trust

Transparency has become a key differentiator for CoinDCX. The release of regular transparency reports—such as the February 2025 report—shows its commitment to openness about reserves, insurance funds, and overall financial health. These reports not only build user trust but also set a benchmark for accountability in an industry that has seen its share of scams and security breaches.

This dedication to transparency reassures users that CoinDCX is not just about profit but also about safeguarding the interests of its community. In an environment where trust is paramount, such initiatives play a critical role in retaining and attracting investors.

Future Outlook

Looking ahead, CoinDCX is poised for further expansion and innovation. The company continues to explore new product offerings, such as advanced DeFi solutions and enhanced lending/borrowing features. There are also plans to broaden its geographical footprint beyond India, tapping into emerging markets where crypto adoption is on the rise.

Investments in technology, regulatory compliance, and strategic partnerships will be crucial for sustaining its growth trajectory. As the cryptocurrency landscape evolves, CoinDCX’s ability to adapt to regulatory changes and market demands will determine its long-term success. With a focus on both innovation and user protection, CoinDCX appears well-equipped to navigate future challenges while maintaining its leadership in India’s digital asset revolution.

With strong backing from global investors and a clear strategic vision, CoinDCX is well-positioned to lead the next phase of India’s crypto revolution. For anyone looking to enter the world of cryptocurrency—whether as a beginner or an experienced trader—CoinDCX offers a secure, user-friendly, and dynamic platform that not only simplifies digital asset trading but also paves the way for broader financial inclusion.

Whale Accumulates Fartcoin as FTM Swaps Signal Smart Moves

A whale reenters Fartcoin with a $9.97M buy after a $3.33M profit, while $2.7M in USDC-to-FTM swaps ...

AltLayer to Offer Faster Finality on Soneium in Partnership with Astar and EigenLayer

The partnership between Soneium and AltLayer aims to unveil fast finality on Soneium, an Optimism (O...

What’s Going On With Crypto30x.com?

Discover what’s behind the buzz around Crypto30x.com — a high-speed trading platform offering 30x le...