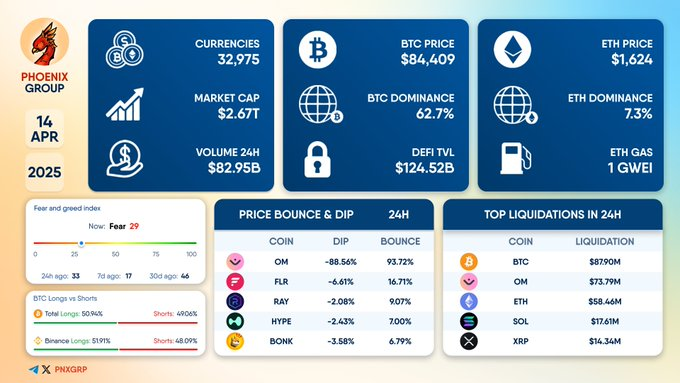

Crypto Market Volatility Deepens as Bitcoin Hits 62.7% Dominance

- Bitcoin strengthens dominance at 62.7% as crypto market cap hits $2.67 trillion.

- Altcoins face extreme volatility with OM plunging 88% before rebounding 93%.

- Crypto liquidations surge, led by $87.9 million in BTC and $73.79 million in OM positions.

The crypto market displayed signs of strain on April 14, 2025, as traders faced price swings and rising liquidations. According to the latest update from Phoenix Group, Bitcoin extended its dominance across the market while broader investor sentiment remained hesitant.

As of April 14, the global crypto market capitalization stood at $2.67 trillion, fueled by the presence of 32,975 digital currencies. Despite ongoing uncertainty, the 24-hour trading volume reached $82.95 billion, reflecting sustained activity from institutional and retail participants.

Bitcoin, the first and most popular cryptocurrency by market capitalization, was worth $84,409. It increased its market share to 62.7% implying that investors required safer assets that BTC offered during the volatility. Ethereum, which is the second largest market capitalization, was valued at $1,624 or 7.3 percent of the total.

DeFi Sector Holds Ground With $124.52 Billion in TVL

The decentralized finance (DeFi) sector remained stable, with the total value locked (TVL) in DeFi protocols recorded at $124.52 billion. This figure indicates continued participation in DeFi platforms despite declining gas costs on Ethereum’s network . Notably, Ethereum’s transaction fees stood at just 1 GWEI, pointing to reduced congestion and lower costs for users.

Fear and greed index, an overall measure of the market optimism, currently stood at 29, putting the market in the “Fear” territory. Still, this reading is bearish and has risen from where it was 24 hours ago (33) and has risen from the extreme of fear score of 17 observed the week before. For comparison, the index stood at 46 a month ago, suggesting market conditions were closer to neutral.

Nonetheless, in the futures market, the buyers and sellers of Bitcoins offered almost similar sentiments. Longs represented 50.94% of the total, while shorts overwhelmed the remainder of the candidates at an overall percentage of 49.06%. Long positions were slightly more on Binance, which was at 51.91% while the short positions were 48.09%.

Altcoins Suffer Steep Declines and Rapid Rebounds

Altcoins were much more active during this period, and among them, OM had the highest fluctuation. It declined by 88.56% in a day and then rose by 93.72%. The scenario was the same for FLR, which declined by 6.61% and then increased by 16.71%. RAY, HYPE, and BONK each experienced moderate declines of 2.08%, 2.43%, and 3.58%, respectively. Their rebounds ranged between 6.79% and 9.07%, highlighting short-term trading activity across smaller-cap assets.

Furthermore, fluctuation in price led to massive sell-offs of different digital assets in the market. BTC contributed the most share to the liquidations with $87.90 million, whereas OM came very close at $73.79 million. Ethereum recorded $58.46 million in forced closures, and Solana (SOL) and XRP $17.61 million and $14.34 million, respectively.

Alchemy Pay Enables Fiat On-Ramps for $ENA and $USDe

The partnership unveils simplified on-ramp support for the native assets of Ethena, including $ENA g...

7 Best Cryptos to Invest in 2025 – #1 Is an AI Token With Real Staking Rewards!

Discover the 7 best cryptos to invest in for 2025, featuring Web3AI ($WAI) as the top pick. Explore ...

Orderly Launches ‘Orderly OmniVault’ to Elevate Crypto Trading

Orderly unveils Orderly OmniVault, combining elite algorithmic trading with smart yield strategies t...