Perpetual Crypto Futures With Massive Leverage Coming Soon?

Even if the US regulatory landscape for digital assets has changed dramatically under President Donald Trump, Americans still can't access one of the most popular and risky crypto products on the market.

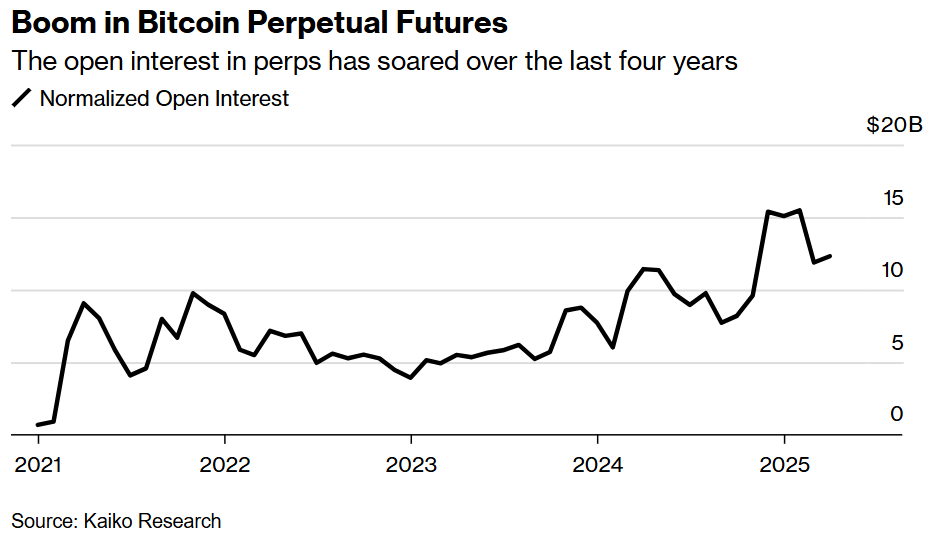

The majority of daily trading activity on crypto exchanges globally is concentrated on perpetual futures contracts for cryptocurrencies, and many industry participants anticipate that this will soon change, allowing US investors access.

The contracts are the primary method for offshore investors to access cryptocurrency markets without directly owning the digital assets while allowing for leverage that can reach up to 100 times.

In contrast to conventional futures contracts, the pricing is recalibrated every eight hours without any expiration dates, enabling a close alignment with spot-market prices.

The endorsement of perpetual instruments, commonly referred to as perps, would further contribute to the increasing risk tolerance observed among US retail traders. These traders are actively engaging with an array of innovative products, including zero-day options and meme stocks.

The US Commodity Futures Trading Commission (CFTC) withdrew two staff advisories on March 28 to explain that digital asset derivatives will be regulated in the same way as traditional products, even though perpetual has not yet been certified by US regulators.

Coinbase Derivatives has just announced plans to launch a revolutionary futures contract in the US market modeled after perpetual contracts.

If the US were to embrace perps, it would be a major step forward in Trump's crypto-supportive administration's loosening of regulatory constraints.

A change has happened recently, with regulators dropping numerous lawsuits against Bitcoin companies.

The president also started the process of creating national token reserves, spoke out in favor of stablecoins, and held a symposium at the White House to discuss digital assets.

These contracts enable cash flows through financing rate payments; they were first introduced in 2016 by the bitcoin exchange BitMEX, which the recently pardoned Arthur Hayes co-founded.

When the rate is positive, those bullish on the market pay off the bearish traders, and vice versa when the rate is negative.

The lack of expiration makes greater speculation and price discovery possible. This improves hedging techniques by preventing traders from rolling over contracts.

The cryptocurrency market is characterized by consistent volatility, and contracts are a part of this oscillation.

If there are major price swings, like the current worldwide trade problems created by Trump's tariff policies or the previous complete ban on cryptocurrency trading in China, many contracts can be sold off.

Crypto perpetual futures had already drawn a huge number of traders before the gamification trend in individual investors' stock trading. Their popularity was mainly due to their clear onboarding procedure and user-friendly interface.

The top cryptocurrency trading platforms are vying for market share in this industry due to the high earning potential they offer.

Although perpetual futures have become popular among investors outside the US, they face competition from various investment products offered in the US market.

Stock market speculation can be facilitated via Bitcoin hedge-fund proxy tactics, digital asset-backed exchange-traded funds (ETFs), and futures contracts offered by the CME.

Concerns about perpetual contracts have not yet been adequately addressed by US regulators, who may decide to cap retail investors' leverage and positions or take other action.

As they enter the US market, these products will likely face several regulatory issues.

Elsewhere

Blockcast

Inside the Crypto & AI-Powered Adult Playground with Oh's Nic Young

Ever wondered what happens when AI, crypto, and the adult entertainment industry collide?

This week, Blockcast delves into the developing space of digital interaction with Nic Young, CEO of Oh , a platform at the forefront of integrating artificial intelligence and cryptocurrency within the adult entertainment industry. Nic unpacks how Oh is building AI-powered digital companions, including realistic twins of creators, offering a personalized and uncensored experience underpinned by crypto transactions: "We felt that it was the perfect incubator... an industry that really needs crypto."

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found on Podpage , with guests like Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our most recent shows.

Morpho: DeFi's Next-Gen Lending Protocol

Why the biggest names in DeFi are copying Morpho...

Blockcast 58 | Licensed to Shill: Current State of Ethereum, Hidden Road Acquisition, Next Gen of Fintech

Blockcast analyzes Ethereum's upgrade, Ripple's prime brokerage move, and fintech's evolution....

Easter Weekend Watch: Geopolitics, Correlations, and Crypto Swings

Your macro cheat sheet....