Ethereum Whale Holdings Hit 9-Year High as Market Concentration Grows

- In the last 24 hours, Ethereum whale wallets have moved more than $174 million back to wallets off major exchanges.

- Whale addresses now control 46% of ETH supply, which is seen as an increase in centralization.

- Ethereum is approaching the realized price point, which implies deep value buying or selloffs.

Ethereum’s whale activity has risen significantly in the past few weeks, pointing to signs of accumulation on the part of the whales. According to Lookonchain data, three major wallets have withdrawn 85,668 ETH, or the equivalent of $174,503,634, out of exchanges since February.

One of the Metalpha wallet addresses moved their Binance storage and exchanged $48.73 million 29,000 ETH from the exchange after April 1st. Another address, 0xd81E, pulled 46,577 ETH, valued at $97.26 million, from Gate.io starting mid-February. The third wallet, 0x6034, took 10,091 ETH from Bybit, approximately $18.8m, within a month since March 12th.

These large movements further show that accumulation among Ethereum whales, often seen as early investors, institutions, or hodlers funds, is a possibility. These transactions occur at a time when Ethereum has approached a key technical value, which is its realized price.

Concentration Rises as Retail Shrinks

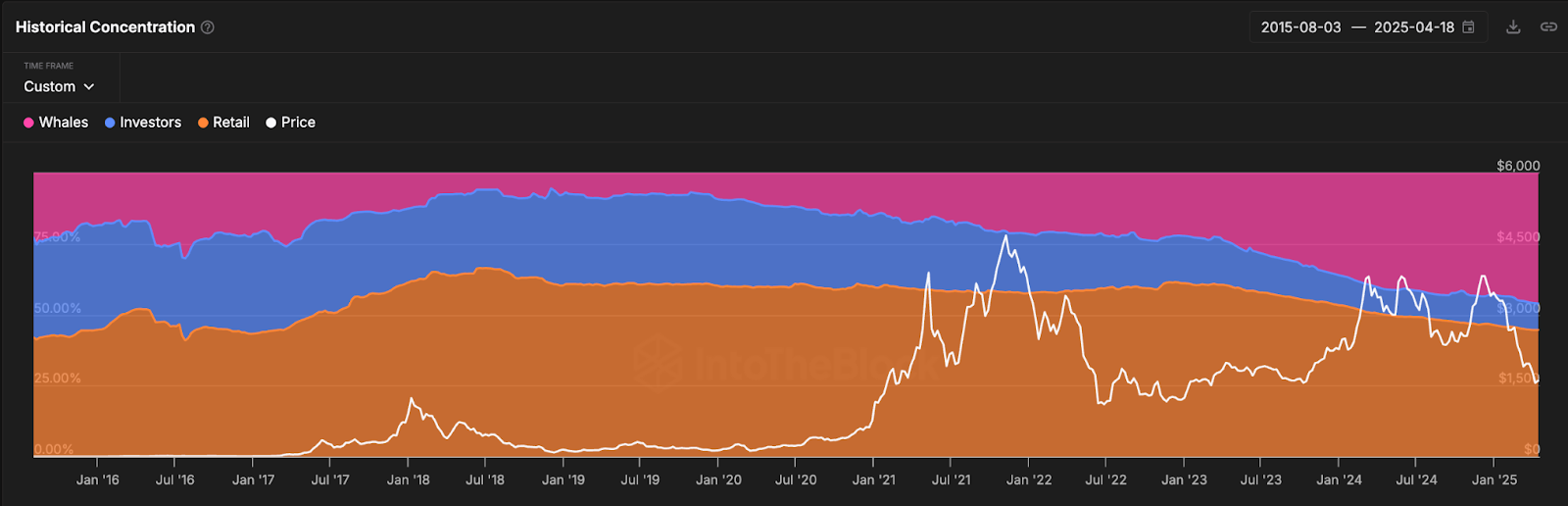

The whale dominance of ETH controlled by whale addresses has risen to 46%, the highest level seen since 2015, according to IntoTheBlock . These long-term investor wallets, holding over 1% of the circulating supply, have only continued to increase. On the other hand, smaller investors and retail holders addresses’ actions have decreased overall ownership.

This change in the retail-to-whale ownership ratio dramatically shifts Ethereum’s ownership structure. Large investors such as whales surpassed individual investors on March 10. Since then, they have increased their share by 3%, raising concerns about the networks’ centralization.

According to the new holdings matrix, whales with between 1,000 and 100,000 ETH own $59 billion worth of the asset, amounting to 25.5% of the total circulating supply. These addresses also do not include the centralized exchange wallets, suggesting that highly funded players are outside the centralized exchange environment.

Such a level of concentrated control could lead to exposure to organizational vulnerabilities. If major holders rotate capital or sell off holdings, that could set off a chain reaction in a market that lacks relative participation by the only active participant, retail investors.

Ethereum Approaches Historical Price Floor

As Ethereum nears its realized price, technical analysts are tracking indicators for signs of reversal or breakdown. As pointed out by analyst Abramchart, the ETH is at the lower Bollinger Bands, which are characterized by macro bottoms and the beginning of bull phases.

“If the trend continues downward, it could signal deep-value accumulation,” Abramchart said. However, they also noted that getting below this level may prolong the bearish pressures and affirm more losses.

Short-term sentiment remains fragile. Popular trader IncomeSharks noted that some bearish trends from the earlier dip-buying attempts were also non-profitable. “Buying every dip doesn’t always work,” they wrote, urging caution amid ongoing volatility.

Strategic Moves or Red Flags?

While the whales’ increase shows their confidence in Ethereum’s long-term potential, it also poses questions about future market trends. With ETH whale addresses holding over 25% of the total supply, the market may soon be more fragile to large holders’ actions.

Large-scale activities such as the $100 million ETH transfer by Galaxy Digital also display the level of ownership by these entities. Whether these actions are signs of strategic posturing to liquidation is, however, not clear.

Hidden Road Secures FINRA License as $1.25B Ripple Acquisition Awaits Approval

Hidden Road secures FINRA license ahead of $1.25B Ripple deal, plans XRPL integration to expand fixe...

BTC ETFs Record Notable Inflows on 18th April, ETH Sees Hefty Outflows

As per Lookonchain, Bitcoin ETFs have cumulatively added 1,147 $BTC while Ethereum ETFs have gone th...

Kalp and SFT Protocol Unite to Boost RWA Tokenization and DePIN Innovation

Kalp and SFT Protocol are collaborating to scale Real World Asset (RWA) tokenization, ensuring secur...