Dogecoin Eyes $1 Rally as On-Chain Metrics Show Mixed Signals

- Dogecoin is trading at $0.15 even after whales sold or transferred more than 570 million DOGE last week.

- On-chain indicators indicate increased wallets and fluctuating daily active addresses and transactions.

- Analysts have forecasted a high probability for a bull breakout, and some target $1.

Dogecoin continues making waves across the entire crypto space as buy and sell signals point at continued upward action despite its current price consolidation. According to renowned crypto analyst Ali Martinez, whale wallets have dumped more than 570 million DOGE over the past week.

Even though the selling pressure has been tremendous, DOGE has been holding well above $0.15, currently at $0.1558. This is contrary to short-term bearish outlooks, indicating that a better fundamental foundation in the market exists.

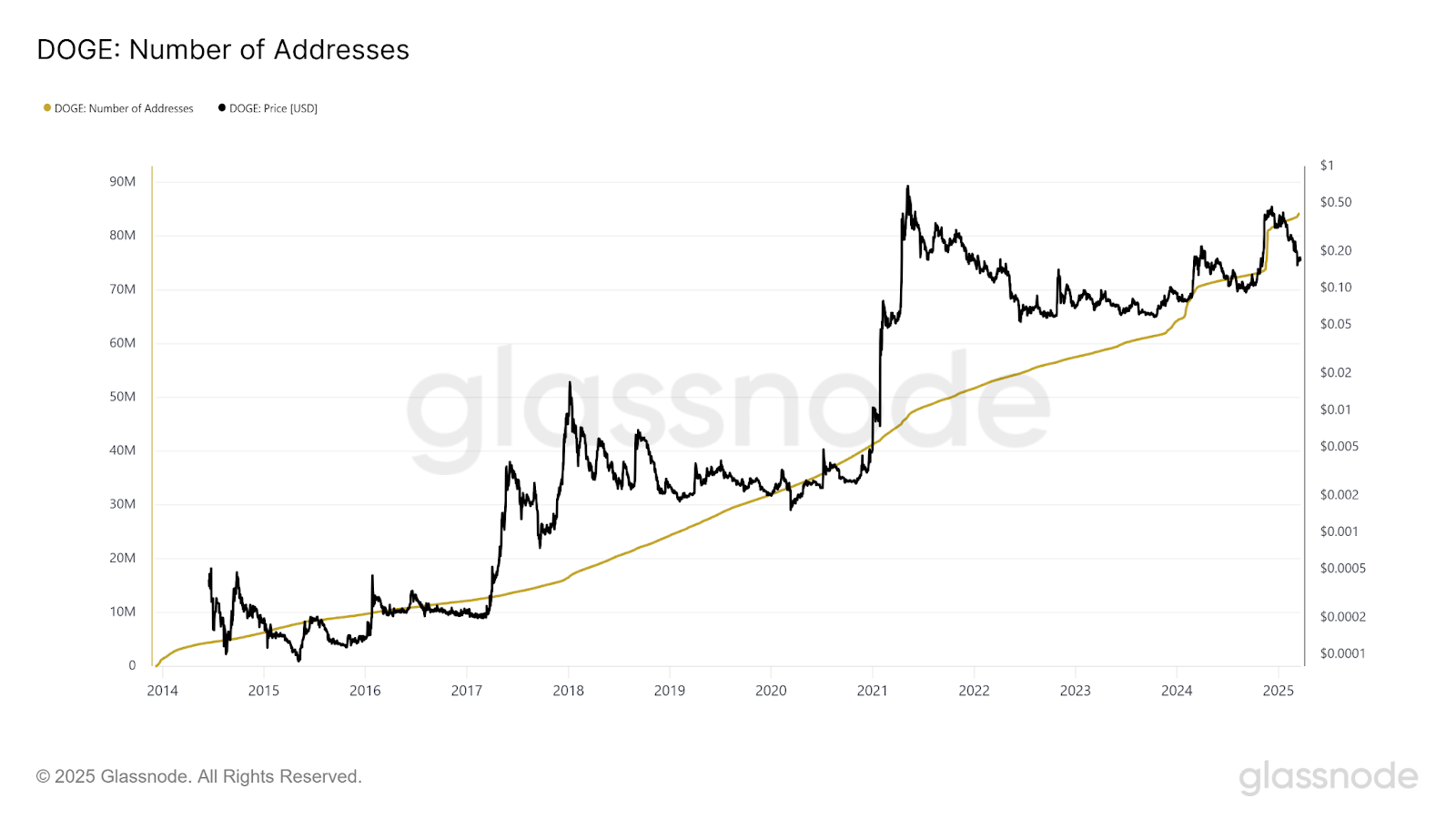

This is supported by glassnode data that reveal an increase in long-term addresses. The number of DOGE addresses has now crossed 85 million, the highest it has ever reached in its history. Although the price remains relatively stable , the constant increase in the number of wallets indicates persistent user interest.

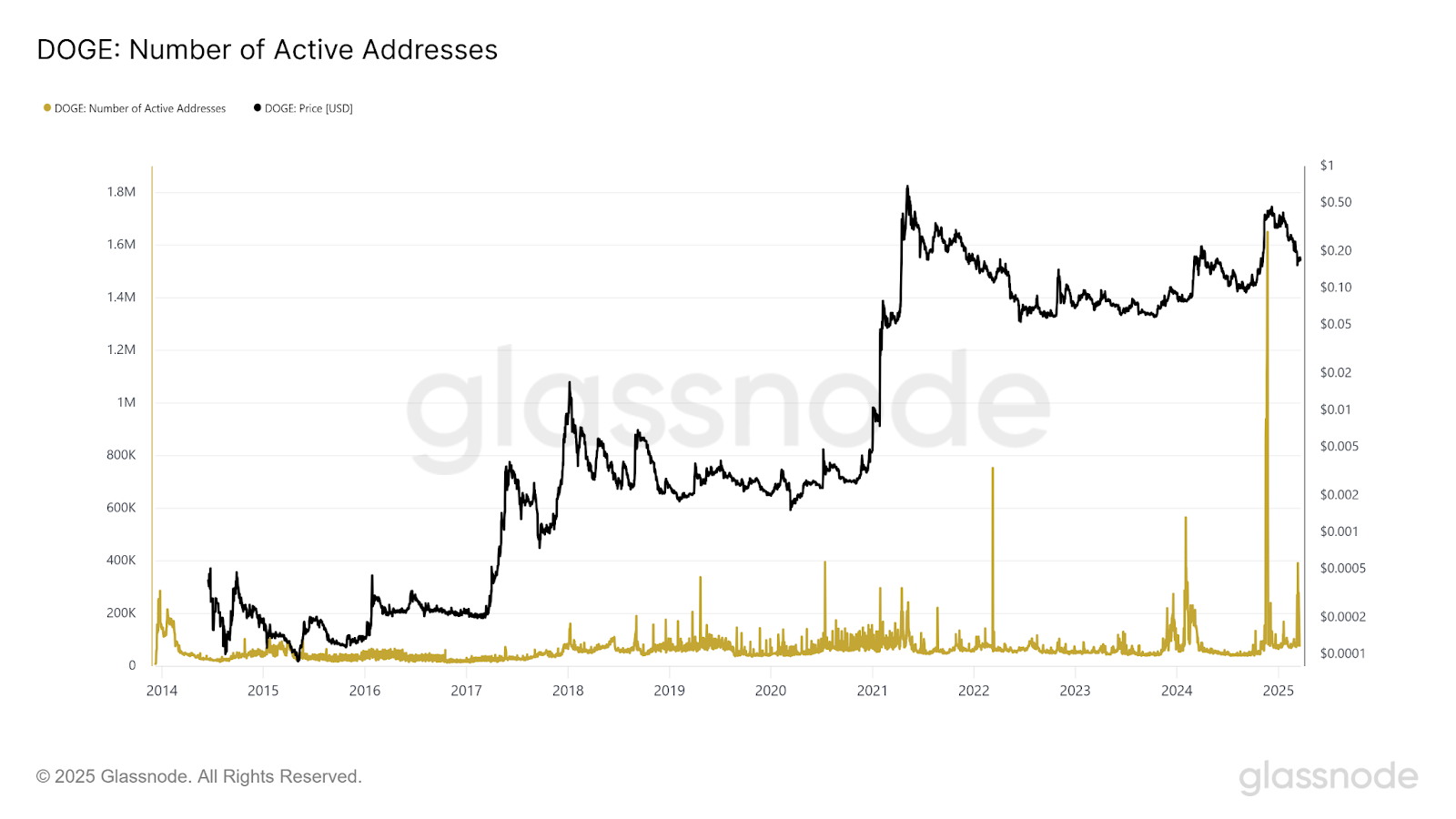

However, active address spikes have been fluctuating. Recently, it has risen to 1.8 million active addresses and above, the highest over the past few years. This short burst could be evidence of a speculative jump or the actions of bots, but they have yet to result in lasting volatility.

Technicals Point to a Reversal, Analysts Turn Bullish

Chart data from TradingView reveals that DOGE has been range-bound after bouncing back from the $0.1515 zone. The Relative Strength Index (RSI) is at 43, hence a neutral area with room for upward movement. The MACD histogram is slowly moving towards the bullish territory, which might signify a change in sentiment.

According to technical analyst STEPH IS CRYPTO, DOGE has already recovered from a support region and has a possibility of rising steeply. In the recent update, the analyst repeated the $1 target, saying, “$DOGE will teleport to $1.00.” Although quite speculative, the statement is in tandem with the rising community expectations of a resurgence of the meme coin rally.

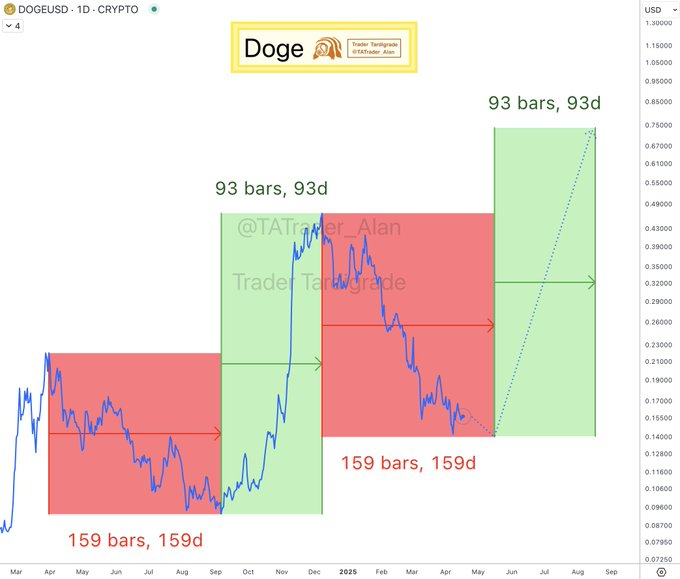

Further supporting the bulls, crypto trader Trader Tardigrade shared that DOGE experienced a 93-day bull run in the past, which was preceded by a 159-day bear phase. If trends persist, DOGE could be experiencing a restart of its bullish phase. Although this theory has a basis in past conduct, historical symmetry has also influenced the previous movement of memecoins.

Transactions and Market Psychology Shift as DOGE Enters Key Phase

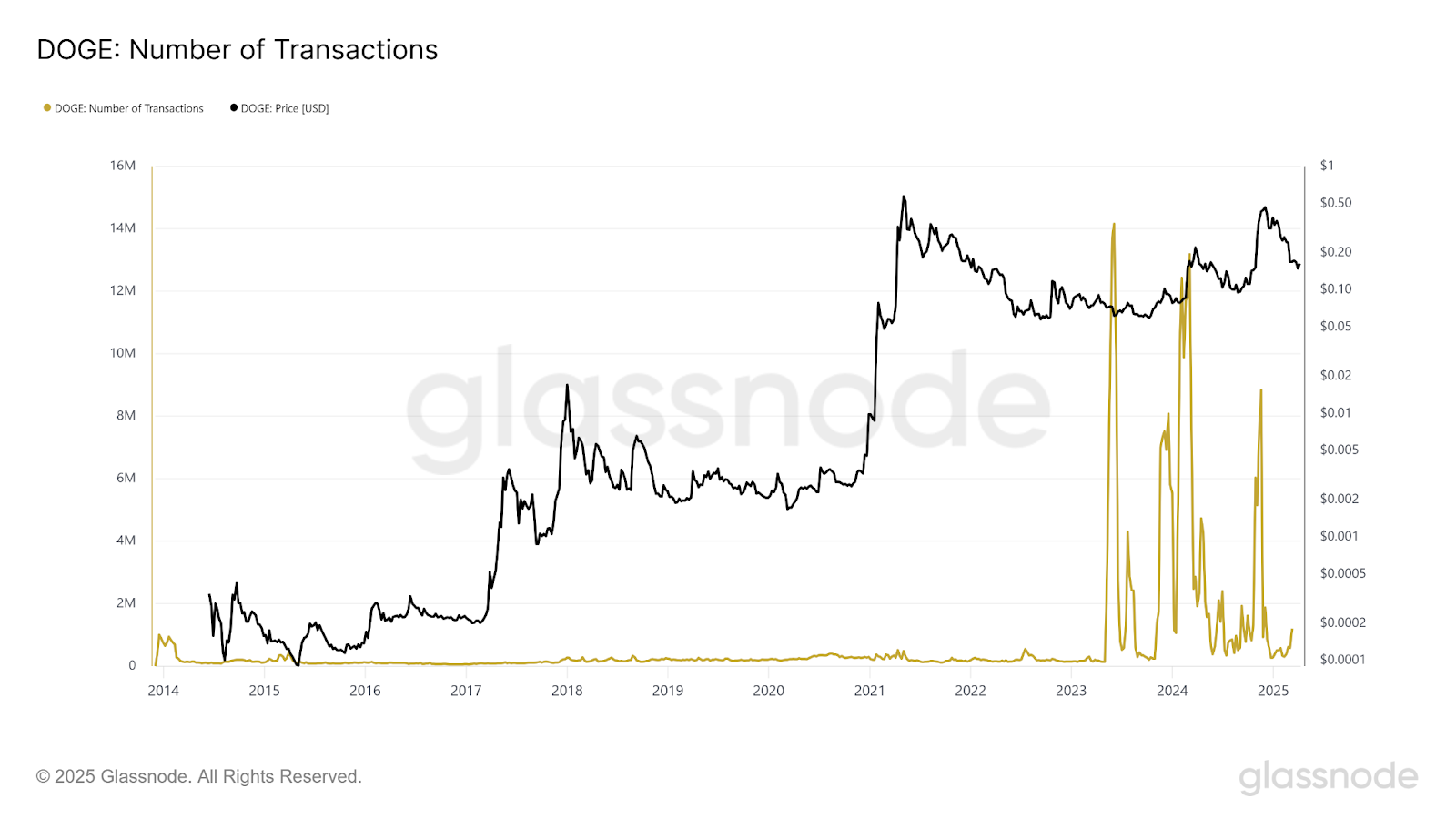

Glassnode metrics also indicate that the average daily transaction count is also very high, with an increase of as high as 14 million in early 2024. Although such a pattern may seem irregular, it indicates more activity at certain psychological levels that are vital.

However, the price of Dogecoin is stagnant and still hovering in a sideways trend, showing a gap between the level of network usage and the coin’s value. As seen in the previous weeks, the bullish trend seems subdued, with traders patiently waiting for a clear breakout before committing to larger positions.

Currently, Dogecoin is trading right above a significant support level. Analysts are still divided, though marks in development and cyclical trends might be sufficient to feed the signs of progress if the buyers return. All are now focusing on the $0.17 resistance level, a vital juncture that may lead to the next surge.

Hidden Road Secures FINRA License as $1.25B Ripple Acquisition Awaits Approval

Hidden Road secures FINRA license ahead of $1.25B Ripple deal, plans XRPL integration to expand fixe...

BTC ETFs Record Notable Inflows on 18th April, ETH Sees Hefty Outflows

As per Lookonchain, Bitcoin ETFs have cumulatively added 1,147 $BTC while Ethereum ETFs have gone th...

Kalp and SFT Protocol Unite to Boost RWA Tokenization and DePIN Innovation

Kalp and SFT Protocol are collaborating to scale Real World Asset (RWA) tokenization, ensuring secur...