Chainlink Shake-Up: Investors Pull $120 Million From Exchanges

Chainlink (LINK) cryptocurrency has witnessed significant token flows off exchanges just recently. Over $120 million of LINK tokens have been taken off trading platforms within the last 30 days, reports blockchain analysis company IntoTheBlock.

Investors Take LINK To Cold Storage

The huge outflow indicates a change in investor sentiment. This trend usually indicates holders moving their funds to private wallets for long-term storage instead of getting ready to sell. When exchange supply declines, prices may increase if demand remains firm or grows.

Whereas most investors now seem to be buying LINK, the market also continues to have occasional whale selling. Such gigantic trades serve to keep liquidity active in the Chainlink economy while striking a balance between selling activity and withdrawals.

Keep an eye on altcoin exchange flows

$LINK has seen consistent outflows from exchanges over the past month, hinting at ongoing accumulation. In total, net outflows surpass $120 million worth of LINK in the last 30 days. pic.twitter.com/XbU4qsGuWd

— IntoTheBlock (@intotheblock) April 22, 2025

Price Pushes Past Key Threshold

LINK’s price recently pierced through the $12.50 support level that has defined its pattern movements earlier this year. As per CoinMarketCap statistics, Chainlink currently trades at $14.45 , 14% higher in the last week, and has a total market value of nearly $10 billion.

Some experts think LINK may hit $26 by December. Such projections, however, are highly dependent on the performance of Bitcoin . Traditionally, when Bitcoin goes up, other cryptocurrencies such as Chainlink follow suit. Any weakness in the overall crypto market may slow down the upward movement of LINK.

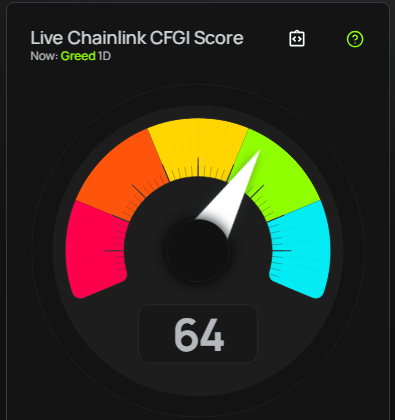

Contrary to the overall optimistic perspective, certain technical indicators predict a possible 28% decline to $10 on May 24, 2025. Present sentiment gauges reflect ambivalence—technical analysis indicates a “Neutral” stance while the Fear & Greed Index measures 64, reflecting “Greed.”

Partnerships And Integrations Grow

Partnerships And Integrations Grow

Under the hood, Chainlink is steadily expanding its partnership network. On April 21, 2025, the Digital Chamber revealed Chainlink Labs had joined its Executive Committee, placing the project closer to regulatory deliberations and policy-making.

A day later, blockchain platform Monad disclosed that Chainlink tools would be supportable on its mainnet from day one. This support covers Chainlink data feeds and cross-chain capabilities.

Chainlink is also collaborating with the large financial institutions like Swift, DTCC, and Fidelity. These partnerships, in addition to integrations on bases like Aave and Lido, demonstrate the project is emphasizing core development over market performance.

Push Into Real-World Asset TokenizationChainlink has lately ventured into tokenized real-world assets (RWAs). According to March reports, Chainlink collaborated with Abu Dhabi Global Market (ADGM) to further tokenization initiatives.

Meanwhile, statistics indicate LINK had 16 green days in the last 30, which is 50% positive price movement days. Price movements have been as high as 8.40% during the same period.

Featured image from Unsplash, chart from TradingView

Ethereum Forms ‘A Huge Inverse Head & Shoulders’ – $20K Target In Sight?

Ethereum is now testing critical resistance after a sharp rally that has caught the attention of ana...

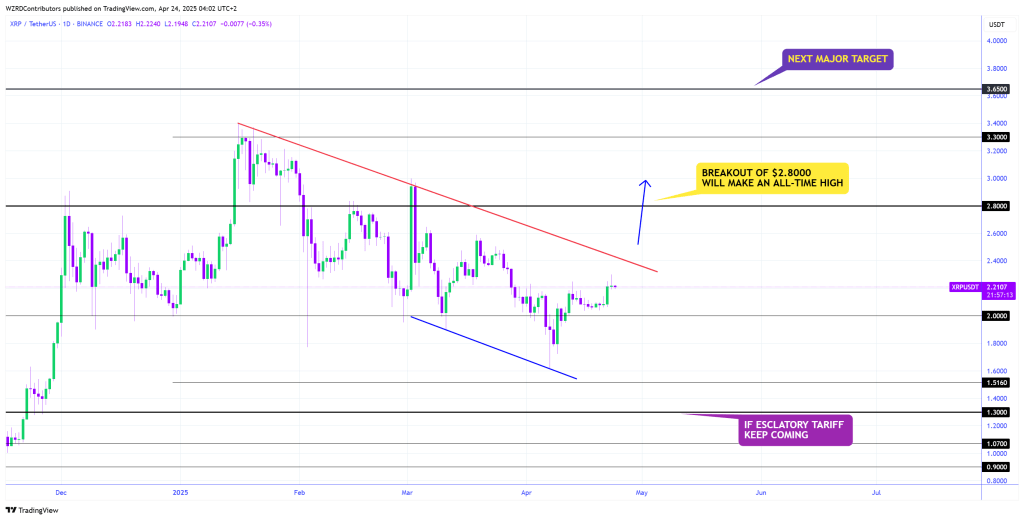

XRP Will Print A New All-Time High If This Happens: Analyst

A fresh daily chart shared by market technician @cryptoWZRD_ suggests that XRP is just one technical...

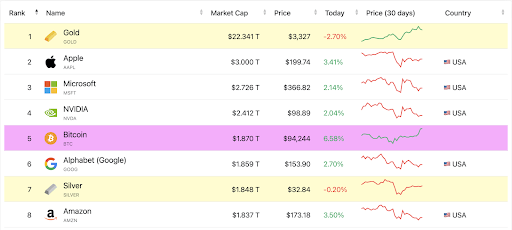

Bitcoin Sees Largest ETF Inflows Since January, Becomes 5th Largest Asset In The World

Bitcoin has spent the majority of the past 24 hours on a notable rally that saw it price peak at an ...