Fed's Crypto Role Under a Vibecession Cloud + a B.R.O. Introduction

The US Federal Reserve's approach is to wait and see how the hard data plays out. The central bank is not perturbed by massive negative bets and moves in financial markets.

But the moves suggest the Fed trigger is not coming anytime soon for cryptos.

If anything, Bitcoin has shown that the next Fed move could be a pause for a longer period than the rate cuts currently pencilled in for the early second half of this year.

The sudden emergence of the term "vibecession" has sparked much concern in the United States, which is unsurprising given the widespread belief that a real recession is imminent.

At least, that is what the market reaction is telling us.

Bitcoin is well below its all-time high of above $109,000 from Trump's first day in office.

The risks associated with US President Donald Trump's massive policy changes and his growing trade war are reasons why many in risk markets share those fears.

However, it appears that the US economy is still holding its own.

In 2023, there was a vibecession, a time of more pessimistic feeling, that hardly slowed the rate of economic growth.

Still, a senior official from the Fed has cautioned that the plans of policymakers to lower interest rates could be derailed if there are indications that bond market investors price in greater inflation.

Economic slowdowns aren't so important to the Federal Reserve.

However, inflationary cycles bring Fed rate hikes and recessions in the economic waves.

Stagflation vs. Inflation

The greatest danger, though, is that even in a 'stagflationary' situation, is the fight against inflation, which may cause rate increases and a recession.

That fear is playing out currently in the crypto market.

Caring about inflation is the Fed's notion. And the markets' vibecession is only important for the US central bank if it causes a real recession.

What we learned in 2023 about the reliability of using polls of customer sentiment and other forms of "soft data" to forecast the future is invaluable.

Nothing you can predict will come true, however compelling the narrative in the market is.

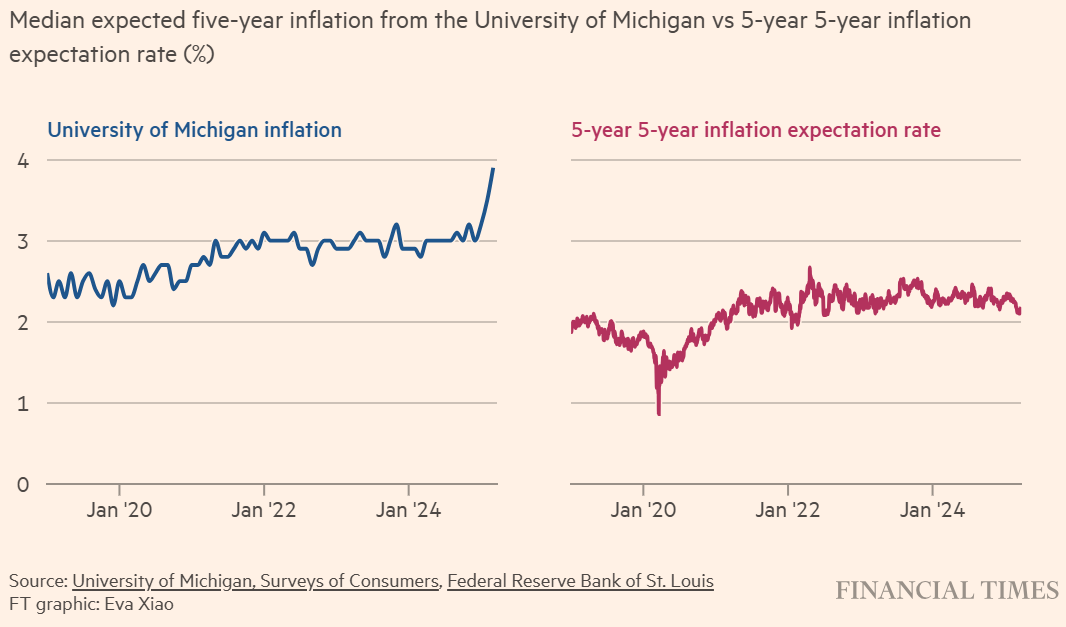

Just over a week ago, a highly anticipated University of Michigan survey revealed that households' long-term inflation expectations reached their highest point since 1993.

Austan Goolsbee, President of the Chicago Fed and a voting member of the Federal Open Market Committee has warned on action based on those soft data.

Last week, in response to the global economic impact of Trump's tariffs, the Fed raised its inflation projection and lowered its growth forecast.

As a result of the muted market sentiment, however, Fed chair Jay Powell has voiced confidence that inflation expectations are under control.

Rates, Rates, Rates

The five-year rate, which indicates how the markets anticipate prices will rise in the second part of the next decade, is 2.2%.

On the other hand, respondents to the UMich survey projected long-term inflation of 3.9%.

Considering the recent background, it's important to examine concrete data for signs of slowing growth.

Data from the University of Michigan indicates that inflation expectations are on the rise, but a crucial market-based indicator is still relatively low.

A key component of central bankers' mandate is ensuring that inflation expectations for the longer term are "anchored" in the market.

A self-perpetuating cycle of rising prices and wages could develop if the public loses faith in them.

Since the US economy experienced the largest price spike since the 1980s, driven by supply limitations caused by the pandemic, the Fed is fighting to bring inflation back in line with its 2% inflation target, making the need to keep expectations under control even greater than usual.

There is a higher potential for negative outcomes from Trump's trade wars.

In contrast to last week, when bond-negative risks were in play but neutral to positive crypto and stock-related risks, this week and next will see slightly more unfavourable risks as April 2 becomes a hot event date.

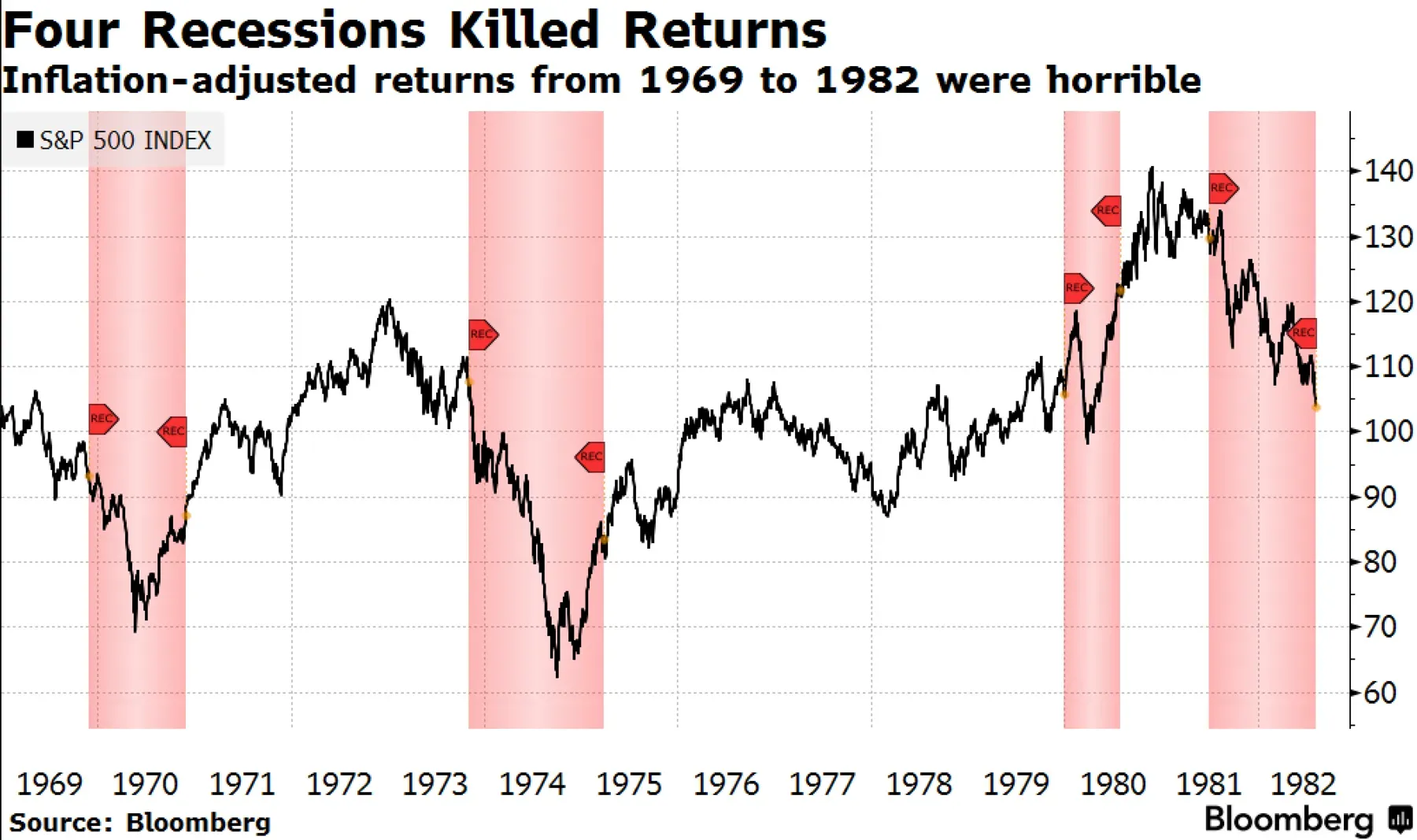

For investors, the current scenarios is similar to the late 1970s. However, merely on a surface level.

To begin, market returns are wiped out during recessions. Otherwise, the stock market and cryptos tend to rise in the absence of a recession.

For the Fed, data from a comparable event three years ago characterized vibecessions as a negative economic indicator.

In retrospect, the current Fed's thought process that vibecessions aren't real recessions is a more appropriate approach.

The bigger fear for the Fed is still inflation and not growth hit from Trump's economic broadsides.

Rate cuts are necessary for the next leg up in cryptos, but if easing comes under extreme economic pressure, the opposite may occur.

More importantly, for cryptos, the Fed's U-turn to rate hikes to counter a surge in inflation is a bigger risk.

Welcome to the Blockhead Research Office (B.R.O.) – Your Edge Starts Here

For the past few years, we’ve made it our mission to bring sharp, independent coverage of the crypto markets to the world. We’ve kept it open, we’ve kept it real, and we’ve built something people actually trust.

Now, we’re taking it to the next level.

Welcome to Blockhead Research Office (B.R.O.)—our backroom for serious market intelligence.

Why B.R.O.?

Most people react to the market. The smart ones get there first.

B.R.O. is built for digital asset investors who don’t wait for the news to tell them what just happened – they already know what’s coming. It’s not another roundup of yesterday’s headlines or a repackaged Twitter thread. It’s what you’d hear if you were in the right room, at the right time, with the right people.

As part of your subscription, Back Room Operators (B.R.O.s) get:

? The Wire – The daily desk note that tells you what’s moving, why it matters, and how to play it. No noise, just signal.

? The Briefing – Your weekly macro cheat sheet, giving you the key global events and trends before the market reacts.

? The Docket – No-fluff project overviews so you know what’s worth paying attention to—and what’s just hype.

? The Ledger – A real-time view of B.R.O.'s model portfolio—our moves, our reasoning, and our strategy.

? The Townhall - Access to B.R.O. events, where the real conversations happen—off the record, in person, and with the right people.

Check out the B.R.O archives here .

What’s Changing?

Everything Blockhead gives you for free—our daily news, the Blockhead Daily Digest newsletter, our market updates, our podcast—is staying free. But if you want the next level, the insights that pay for themselves, B.R.O. is where you’ll find them.

? For a limited time, we’re letting early subscribers test drive B.R.O. If you want in, now’s the time.

Better Returns Only – Because that’s the real goal. Not hype, just strategy.

Elsewhere

Blockcast

Chris Yu co-founded SignalPlus in 2021 to address key gaps in the crypto options market, leveraging his experience as a trader and his insights into the market's early-stage potential.

In this Blockcast episode, Yu explains why he sees the state of crypto options resembling the FX options market around 2000 and why there is an opportunity to build infrastructure that could scale with the industry's growth.

Previous episodes of Blockcast can be found on Podpage , with guests like Samar Sen ( Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!

Subscribe on LinkedIn

Blockcast 56 | Lombard Co-Founder Jacob Phillips on Bitcoin DeFi's Challenges and Innovations

Jacob Phillips entered crypto in 2018, co-founded Lombard in 2024, focusing on Bitcoin liquidity and...

Top Crypto Stories This Week: From a Blockhead B.R.O Introduction to a Blockhead Bro Farewell

Blockhead's B.R.O. spreads its wings while a Blockhead bro flies solo...

Nigeria Continues Search for Escaped Binance Exec Nadeem Anjarwalla

Nigeria continues its pursuit of Binance exec Anjarwalla, who fled to Kenya after escaping custody...