Ethereum Price Prediction for March 31: Can ETH Hold Above $1,850 After Rebounding from Lows?

- Ethereum rebounds above $1,840 amid short-term bullish indicators and rising volume.

- On-chain data reveals weak user engagement despite recent price recovery.

- Long-term growth hinges on real-world adoption and sustained fee-driven network activity.

Ethereum (ETH) is moving through volatile conditions as it attempts to regain strength following a decline earlier in the month. The cryptocurrency, which had dropped below the critical $1,800 support level, saw a modest rebound on March 31, rising to $1,850.95. This rise marks a 2.06% gain in just four hours, reflecting signs of short-term recovery amid broader market uncertainties.

ETH’s price climbed 1.56% over the 24 hours to reach $1,840.47 by the end of March 31, according to CoinMarketCap. Its market capitalization rose by 1.57% to $222.06 billion, while the 24-hour trading volume surged by more than 53%, hitting $15.63 billion. The price earlier dipped below $1,790 before recovering throughout the trading day.

Ethereum’s fully diluted valuation is nearly the same as its market cap, standing at $222.07 billion. The circulating and total supply remains fixed at 120.65 million ETH, with no maximum cap. The volume-to-market cap ratio of 6.98% reflects increased investor activity, suggesting a temporary rise in trading interest.

On-Chain Metrics Highlight Weak Network Activity

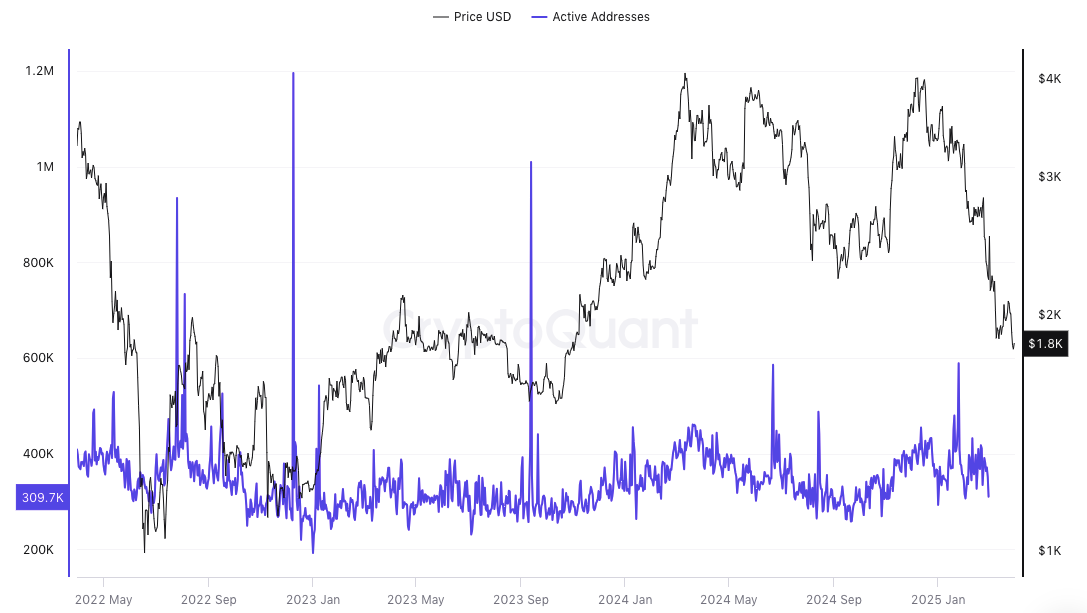

Despite the price rebound, on-chain data indicates waning user engagement. CryptoQuant’s data shows a constant decline in Ethereum’s network activity since early 2024. Active addresses have remained around 300,000 daily, with occasional spikes that failed to maintain momentum.

The price value of $1,800 emerged during a period where active address numbers decreased significantly. The data demonstrates that user interaction decreases when prices rise, indicating a drop in network participation level and increased user caution.

Technical Indicators Suggest Recovery Potential

The current price activity points to Ethereum starting a recovery trend. The Relative Strength Index (RSI) has reached 43.15 in the 4-hour timeframe after dropping to 25.73 recently. The current reading below 50 reveals bearish momentum weakening as new investors participate in buying activities.

The MACD indicator reveals a positive signal following its crossing above the MACD signal line. The MACD indicator stands at 4.90 and has exceeded the -40.75 signal line. This bullish crossover and green histogram bars point to a potential shift in trend direction.

While Ethereum has yet to confirm a breakout, if momentum holds, it may test resistance between $1,900 and $2,000. Failure to maintain upward pressure could lead to renewed declines.

However, according to Ethereum investor Ryan Berckmans, long-term price targets like $20,000 depend heavily on real-world adoption and sustained fee growth. He emphasizes that high token prices are closely tied to trust and high usage fees on the network. Berckmans believes that reaching ambitious price goals requires a resurgence in network activity and total fees, which is essential for restoring investor confidence.

FAQs:

Why did Ethereum rebound to $1,850.95 on March 31?

Ethereum’s price increased by 2.06% due to improved market sentiment and bullish momentum indicators. A sharp rise in trading volume also supported the rebound.

What do technical indicators say about Ethereum’s short-term outlook?

The RSI and MACD suggest weakening bearish momentum and a potential trend reversal. If momentum continues, Ethereum may test resistance around $1,900–$2,000.

What challenges could affect Ethereum’s long-term growth?

Declining active address activity and low total fees indicate weak user engagement. Long-term price growth may depend on real-world adoption and sustained network usage.

Crypto Market Holds Steady as $BTC Hits $82,959 and $ETH Rises

Bitcoin ($BTC) $82,959 and Ethereum ($ETH) touches $1,843 as market sentiment remains cautious with ...

Binance Dominates Spot Trading Volume in 2025, Outpacing Competitors

A recent report by CryptoQuant shows that Binance currently maintains its position as the regulatory...

Top 9 Upcoming Token Unlocks This Week: SUI, DYDX, ZETA, ENA, IOTA, & Others

Such planned unlocks are crucial for sustaining market stability and eliminating price collapses by ...