Bitcoin Price Could Reclaim $95,000 — But Watch Out For This Resistance Level

It’s been exactly a month since the Bitcoin price lost the $90,000 level, falling to around $77,000 in a single move. The premier cryptocurrency has yet to recover from this downturn, struggling to break out of the $82,000 – $87,000 range over the past few weeks.

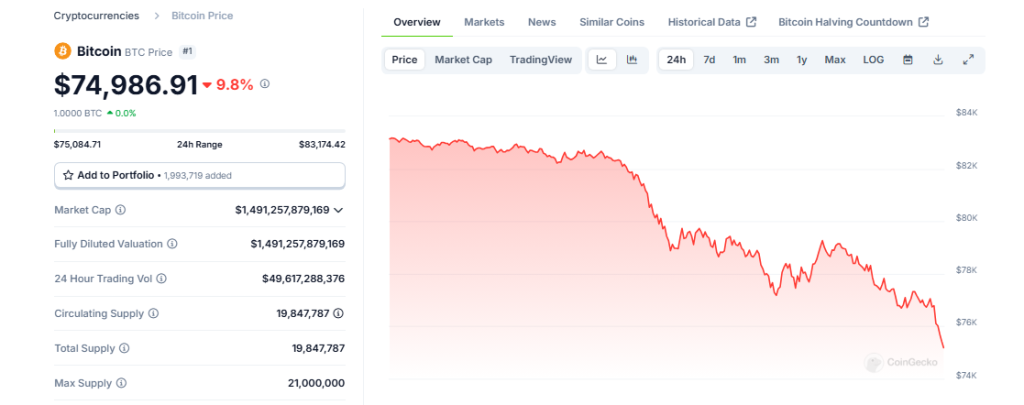

As of this writing, the price of Bitcoin is hovering around the $83,000 level, reflecting a mere 1% decline in the past 24 hours. According to data from CoinGecko, BTC’s value has barely changed over the past seven days.

Here’s How Bitcoin Price Could Jump 15%

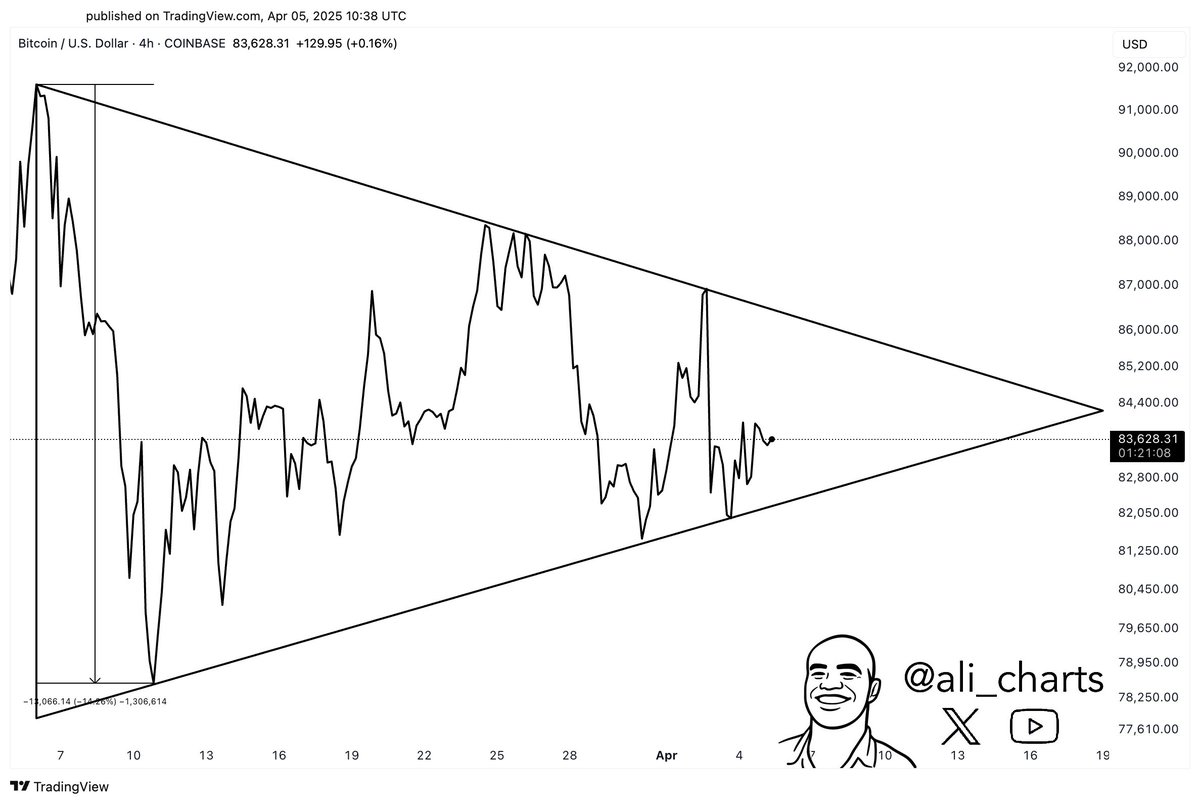

Popular crypto analyst Ali Martinez took to the X platform to share an exciting analysis of the price of Bitcoin. According to the online pundit, the market leader seems primed for a 15% move to the upside over the coming days.

This bullish prediction is based on the formation of a symmetrical triangle on the four-hour Bitcoin price chart. The symmetrical triangle is a technical analysis pattern characterized by a diagonal falling upper trendline (connecting the swing highs) and a diagonally rising lower trendline (along the swing lows).

With its price narrowing towards the apex of the triangle, there is a likelihood that BTC will breach the upper trendline for a breakout. According to Martinez, if the Bitcoin price successfully breaks out of this pattern, investors could see the premier cryptocurrency register a bullish 15% move to around $95,000.

$87,000 Could Prove Pivotal To This BTC Move

Martinez revealed in a separate post that the Bitcoin price might need to overcome a major resistance level to resume its bull run. This is based on the formation of a “confluence zone,” which represents a price range where multiple technical resistance levels meet.

This confluence range seemingly forming on the daily timeframe of the Bitcoin price chart would consist of the 50-day and 200-day moving averages (MAs) and a descending trendline. The 50-day moving average acts as a gauge of short- to mid-term trend direction and as a dynamic support and resistance level.

Similarly, the 200-day MA is used as a long-term trend indicator, with a break above it considered a major bullish reversal signal. Meanwhile, the Bitcoin price has been forming lower highs (connected by a descending trendline) since reaching the all-time high of $108,786.

As mentioned earlier, the Bitcoin price has been trading in a consolidation range over the past few weeks, with the bulls unable to make a sustained upward run. However, the recent show of strength in the face of growing macroeconomic uncertainty somewhat strengthens a bullish case for the flagship cryptocurrency.

In any case, investors might want to pay extra attention to $87,000, as the convergence of three technical resistance indicators increases the likelihood of a price rejection at the level. Moreover, the Bitcoin price had already tried breaching this mark in the past week before correcting back to around $82,000.

Bitcoin Dips Below $75K As Markets Tremble: What’s Going On?

Bitcoin prices fell below $75,000 on Monday, April 7, the lowest since mid-March as investors reacte...

Dogecoin Crashes 20%, But ‘Bull Line’ Signals Hope For HODLers

Amidst a broader crypto market crash, the Dogecoin price is down more than 20% in the last 24 hours....

Dogecoin Volume Remains Low As Price Tanks, Analyst Says Another Surge Is Coming

Dogecoin has seen a major drop in volume since hitting two-year highs back in November 2024. This vo...