Satoshi Nakamoto’s Bitcoin Stash Tops $100 Billion

- Satoshi Nakamoto’s BTC stash is worth over $103 billion, and Bitcoin’s price is $94,000.

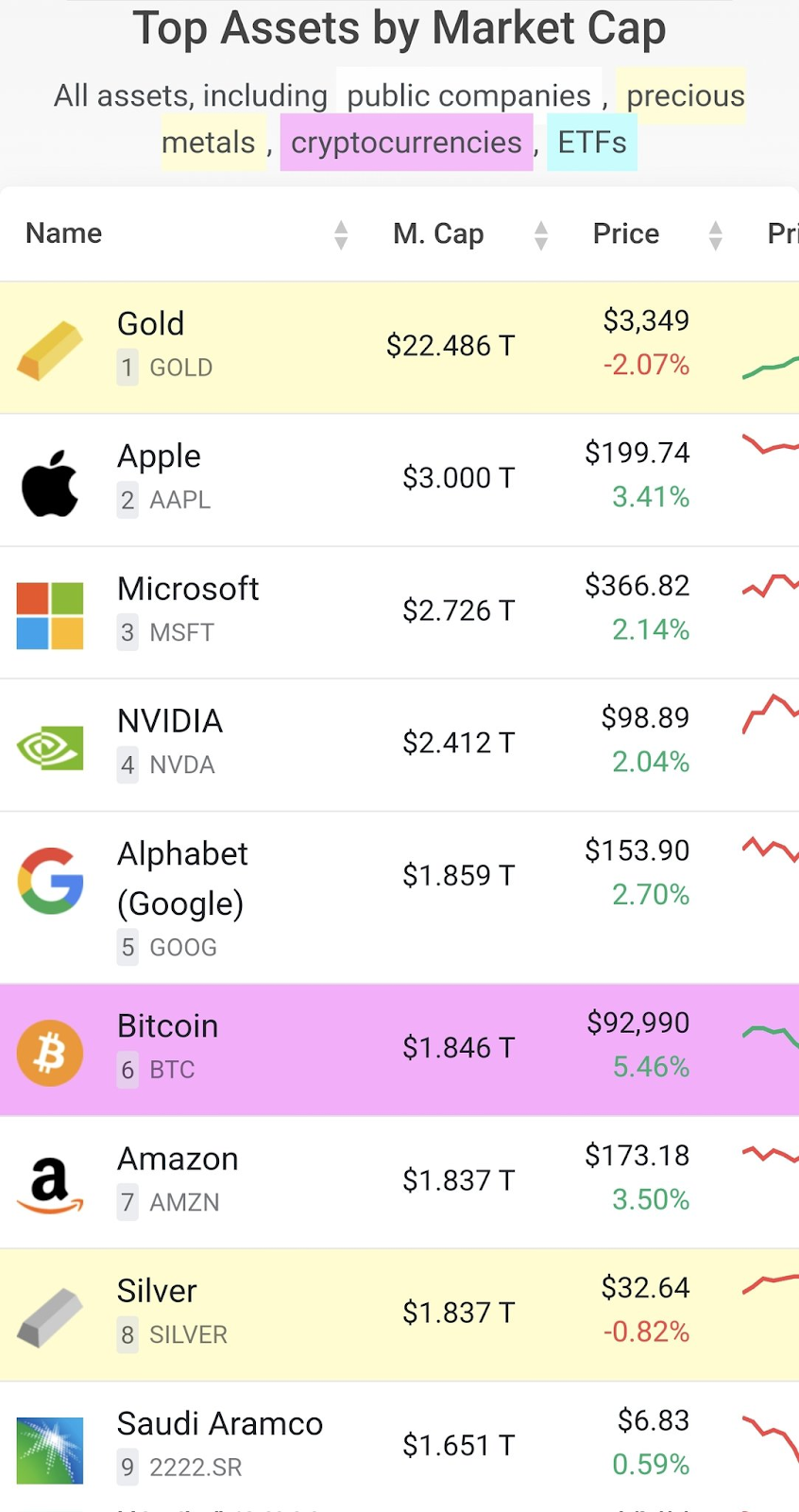

- Bitcoin is now ranked higher than Silver and Amazon as the sixth most-valued asset in the world.

- U.S. states and Wall Street are embracing Bitcoin through reserves and ETFs.

Bitcoin’s anonymous creator, Satoshi Nakamoto, now owns over $103 billion worth of BTC after a significant increase in BTC’s price . Blockchain data from the Arkham intelligence platform revealed that the collective worth of more than one million Bitcoin linked to Nakamoto increased during these market fluctuations.

The substantial rise confirms the original supposition of Nakamoto’s stakes, which have not been moved even since the network’s inception. Since then, Arkham Intelligence has attributed Nakamoto’s legacy to 1.096 million Bitcoin distributed across 22,000 wallet addresses.

This attribution is based on the ‘Patoshi Pattern’, a mining behavior associated with the initial blocks of Bitcoin. The on-chain analysis also revealed what is thought to be the only recorded BTC spent from the addresses by Nakamoto.

As of this writing, Bitcoin is currently trading at $94,321, which is up 6.72% in the last 24 hours, thus raising the total value of Nakamoto’s Bitcoin. Therefore, the estimated value of these assets totals around $103.41 billion.

Bitcoin Pushes Past Amazon and Silver, Eyes Alphabet Next

The latest upward movement in the Bitcoin price has seen it get listed among the world’s most valuable assets as it moved to the sixth spot, surpassing Amazon and Silver. The digital asset rose to $94,311, taking its market cap closer to that of Alphabet of $1.859 trillion.

The price surge has seen Bitcoin labeled one of the world’s most important assets, rising past Amazon and Silver to rank sixth. Its price rallied to $94,311, giving it a market cap of $1.846 trillion, nearly touching Alphabet’s $1.859 trillion.

The new shift caused a lot of reactions on social media, with many suggesting that Bitcoin would be next for giants such as Alphabet and Apple. According to CompaniesMarketCap , Bitcoin has now surpassed Amazon.com Inc. and Silver in terms of market capitalization.

This increase corresponds with the optimism from leading investors. BitMEX’s former CEO, Arthur Hayes, previously forecasted the price of Bitcoin to climb to $110,000 based on major economic changes and rising institutional demand.

U.S. States, Wall Street, and Governments Expand Bitcoin Exposure

Bitcoin’s price surge is not happening in isolation. Over 15 U.S. states are reportedly considering legislation to fund BTC reserves using taxpayer dollars or sovereign wealth funds. Washington is even exploring the idea of a national strategic Bitcoin reserve.

This surge in the price of Bitcoin is not unique to it alone. More than 15 U.S. states are in discussions to seek legislation allowing the accumulation of assets in BTC using taxpayers’ money or sovereign wealth funds. Washington is already considering having a national reserve of Bitcoin as well.

Wall Street has also stepped up the purchasing of Bitcoins. US-listed spot BTC ETFs have secured over $110 billion in their inaugural year, pointing to the increasing interest from institutional investors. These products are being sponsored by large firms such as BlackRock, Fidelity, and ARK Invest.

Bitcoin Sees 57,000 BTC Derivatives Inflows, Rise in Open Interest Signals Market Rally

The Bitcoin Open Interest has recorded a tremendous surge as the token’s price has rebounded above $...

PancakeSwap Breaks Records with $205B Q1 Volume, Elevating DeFi Momentum

PancakeSwap hits $205B trading volume if Q1 2025, marking its strongest quarter ever and showcasing ...

Bitcoin Overtakes Google in Global Asset Rankings, Eyes NVIDIA Next

Bitcoin jumps to the 5th spot in global asset rankings, surpasses Google, nears NVIDIA, backed by st...