Bitcoin ETFs Drive $951M Crypto Inflows as Institutional Activity Rises

- Bitcoin ETFs captured over 95% of $951M crypto ETF inflows in 30 days.

- iShares and Fidelity dominate Bitcoin ETF AUM, totaling over $68B combined.

- Ethereum ETFs remain active but lag with just $8.2B AUM and $38.8M in inflows.

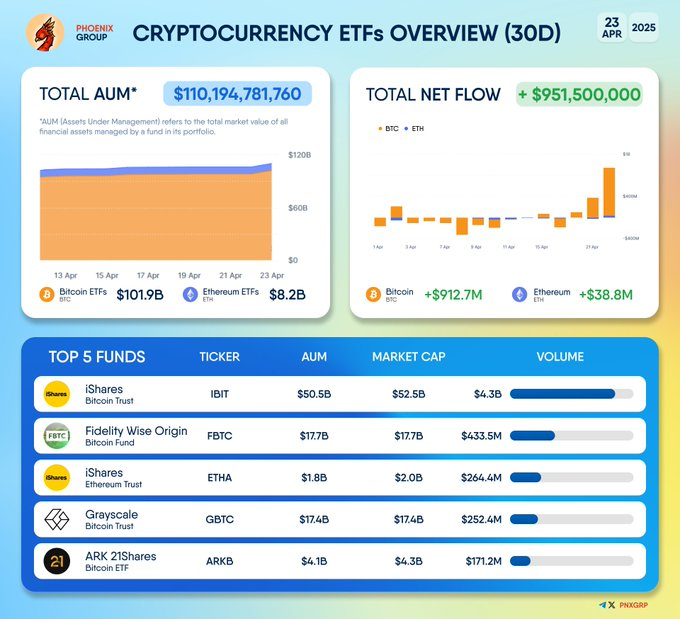

The crypto ETF market is gaining traction, with fresh inflows nearing the $1 billion mark over the past month. As of April 23, 2025, total assets under management (AUM) across regulated crypto exchange-traded funds have reached $110.19 billion, according to Phoenix Group data. A large share of this growth has been attributed to Bitcoin ETFs, which continue to draw capital from institutional and retail investors seeking regulated exposure to digital assets.

Out of the $951.5 million in net inflows recorded over the last 30 days, Bitcoin-based ETFs accounted for $912.7 million. This represents 95% of the total ETF inflows into the crypto scene during the specified period. According to the latest data, the AUM of Bitcoin ETFs equals $101.9 billion, proving its dominance in the market.

ETFs related to Ethereum, on the other hand, saw net inflows of $38.8 million, and total AUM stands at $8.2 billion. Another result shows that while Ethereum products are still trending among investors, their market remains much smaller than that of Bitcoin.

iShares Bitcoin Trust Leads ETF Rankings

Among the top-performing products, the iShares Bitcoin Trust (IBIT) maintains the leading position in terms of AUM. The fund currently manages $50.5 billion, with a market capitalization of $52.5 billion. Its 30-day trading volume stands at $4.3 billion, making it the most actively traded crypto ETF in the current cycle.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) holds the second-largest share, with $17.7 billion in AUM and a matching market cap. Over the same period, it recorded a trading volume of $433.5 million. These two funds alone account for over 61% of total Bitcoin ETF assets under management.

Grayscale Bitcoin Trust (GBTC) also remains a participant, reporting $17.4 billion in AUM and a trading volume of $252.4 million. Meanwhile, ARK 21Shares Bitcoin ETF (ARKB) manages $4.1 billion, with a volume of $171.2 million. These funds reflect continued investor participation across legacy and recently launched Bitcoin investment vehicles.

Ethereum-Based ETFs Maintain Market Presence

However, these ETFs are still present among the top five offerings regarding AUM, even though their market share is not as colossal. The amount of assets under the management of the iShares Ethereum Trust (ETHA) is at $1.8 billion. Although it is still ranked below most of its Bitcoin counterparts based on the trading volume and market capitalization, Ethereum’s presence in the top five indicates its consistent position among the regulated cryptocurrency investment funds.

The comparatively low performance of Ethereum ETFs may reflect current allocation preferences rather than an absence of market demand. As the general crypto market evolves, Ethereum-based products could see renewed momentum driven by future upgrades or adoption trends.

Rising ETF Volumes Reflect Market Confidence

The increase in inflows hints at the growing interest and better sentiment in the crypto market. Whereas Phoenix Group’s AUM and volume reflect an industry view, the increase amounted to a return of capital to regulated funds during the market stabilization.

The total of $951.5m in net inflows has risen sharply from previous quarters, which implies that investors rebalanced to crypto-funded derivative contracts. Bitcoin is still the most represented asset in this aspect of the total, reaffirming its position as the initial point of reference for new and returning investors.

DWF Labs and Mask Network to Advance Decentralized Social Infrastructure in Latest Partnership

The latest between DWF Labs and Mask Network partnership aims to grow decentralized social infrastru...

Spores Network Partners with Now Chain to Advance Mobile-Powered Web3

Just recently, Spores Network has announced a strategic alliance with Now Chain to innovate in mobil...

Bitcoin Sees 57,000 BTC Derivatives Inflows, Rise in Open Interest Signals Market Rally

The Bitcoin Open Interest has recorded a tremendous surge as the token’s price has rebounded above $...